Answer these simple questions and we will find you the BEST prices

Which type of solar quotes do you need?

It only takes 30 seconds

100% free with no obligation

- GreenMatch

- Windows

- Windows on Finance

Windows on Finance in the UK: Payment Options Explained

- Window finance schemes allow homeowners to spread the cost of their purchase over an extended time period.

- Finance options include interest-free credit, flexible payment, buy now pay later schemes, and lump sum payments.

- By spreading out the costs, you can obtain windows quicker and can avoid ruining your credit score.

Paying for new windows on finance allows you to spread the cost over an agreed period of time. This could allow you to replace your windows with more efficient, stylish and secure models without making a single lump sum payment.

The length of time you have to make the payments and how much you'll need to pay each month will come down to the agreement with the installer. In this article, we'll give you an overview on what you need to know about windows on finance.

If you’re looking to save money, you should compare window quotes. Yet, finding even a single quote is a stressful and tedious task when done alone.

Thankfully, GreenMatch can help you avoid this stress. Fill in a 30-second form, and we'll take it from there. We'll provide you with up to 4 free, non-binding quotes from qualified window installers. You can then compare the quotes and choose the best deal. Click the button below to begin.

- Quotes from local engineers

- Payment by finance available

- Save up to £140 per year

It only takes 30 seconds

Windows on finance explained

Similar to how you might pay for a car, buying windows on finance allows you to pay for replacement windows with monthly payments. The terms of the agreement will determine the amount payable each month, the length of the contract, and whether you will need to pay interest.

These schemes can improve the affordability of your windows by stretching out the window costs. Moreover, the energy savings per month from better insulation and heat control can help earn back a bit of the money spent.

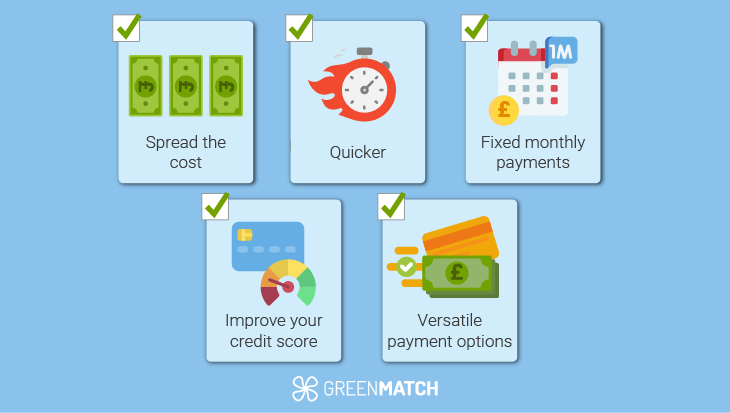

Benefits of paying for windows on finance

Choosing to pay through a window finance scheme can be beneficial for many reasons, including:

- Spread the cost: By dividing up the costs, you can pay back slowly while reaping the benefits of windows, such as decreased heating costs, which can save you money.

- Quick installation: Get your new windows installed sooner rather than later, and with a good fixed payment deal, you can potentially avoid seasonal price increases.

- Fixed monthly payments: With fixed payment options, you can easily plan out your future payments to suit your budget.

- Improved credit score: By not taking up additional credit for your purchase, you can maintain a better credit score without having to sacrifice your comfort.

- Versatile payment options: Wide range of payment options suitable to different incomes, helping people choose the most suitable one.

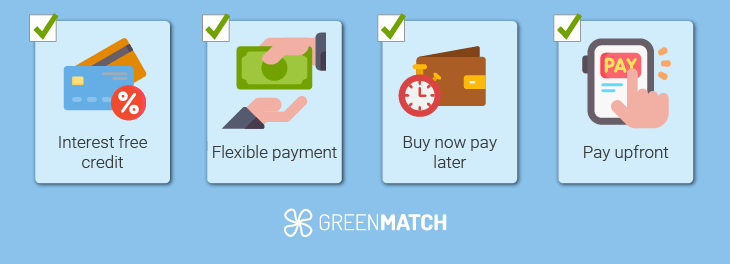

Different types of payment plans

Paying out windows finance schemes can take many forms, including but not limited to Interest Free Credit, Flexible Monthly Payments and Buy Now Pay Later arrangements. We've taken a closer look at each of these in a little more detail, giving examples of how they may work.

Interest-free credit

By paying half of the total cost of the replacement windows upfront, you could potentially pay the rest over 24-36 months without any interest. Interest-free credit can save you a lot more money when compared to payments with interest.

- Pay monthly over a period of 24 or 36 months

- 0% APR (Annual percentage rate) Representative

- No interest

- 50% of the total cost will be payable upfront

- May be subject to window replacement work of a certain value

- May require a deposit

Some stipulations can be added to interest-free credit schemes. Some companies require either a deposit or a minimum order amount. This can vary based on the installer.

Flexible

Flexible payments are a way to spread the cost over a lengthy period of time – sometimes up to 15 years. You will have to pay interest but, as well as the set monthly payments, you can also contribute at any other time to lower the future monthly instalments.

- No deposit

- APR Representative

- Spread the cost over a number of years (often up to 15 years)

- Length will depend on the total cost of the window replacement

- Often possible to make additional payments to shorten the contract

Buy now pay later

A 'buy now pay later' approach would give you some breathing space between when the work is completed and you need to start making payments. For example, you may be given a 12 month grace period then monthly payments (including interest) would need to be made.

To be eligible, the work will likely have to come to a certain amount.

- Don't need to make any payments for a certain period after the installation (12 months, for example)

- Avoid paying interest if you pay for the full amount of the work before the monthly repayments begin

- You may need to make monthly payments over a period of 10 years

All of the above windows on finance arrangements are examples and could differ depending on the company installing your replacement windows. Before agreeing to any windows on finance payment plan, always check through the terms and conditions.

Pay upfront

Rather than opting for any windows and doors finance payments, you may want to pay for your new installations upfront. Your installer will let you know their preferred payment method which could be cash, cheque, online bank transfer or by card.

When you finance windows by paying upfront, it can simplify the process and decrease red tape. You also won’t have to put up with additional payments or interest.

uPVC windows can be the cheapest option, while wooden windows can be up to 3 times as expensive. Although uPVC is cheaper it may not last as long as wooden windows and can provide less savings. Aluminum windows and composite windows can be a good mid-price option.

Window styles can also add differences to the prices. Casement windows are the cheapest option, with sash windows, bay windows, and French windows being more expensive.

Am I eligible for window grants?

There are a few grants for obtaining double glazing on finance through government programs.

| Grant name | Installation types | Regions | Annual Energy Savings |

|---|---|---|---|

| ECO4 scheme | Varies based on inspection | England, Scotland, Wales | £140 to £150 per year |

| Affordable Warmth Scheme | Draught-proofing windows and doors, replacing single glazed windows | Northern Ireland | £140 to £150 per year |

| Home Upgrade Grant (HUG2) | New windows, doors and draught-proofing | UK | £140 to £150 per year |

| Home Energy Scotland Grant and Loan | Upgrading single glazing and draught proofing available on loan | Scottish homeowners | £140 to £150 per year |

| Great British Insulation Scheme (previously known as ECO+) | Currently, only insulation measures | England, Scotland and Wales | Up to £100 per year |

| Welsh Government Warm Homes Nest Scheme | Energy efficient home improvements (currently excludes double glazing) | Wales | Up to £100 per year |

| Warmer Homes Scotland | Energy efficient home upgrades, including insulation, new boilers (currently excludes double glazing) | Scotland | Up to £300 per year |

Many grants are authorised and regulated by the UK government and the Financial Conduct Authority through means-testing. These installations can thus be contingent on the status and affordability of the windows in relation to the homeowner's income.

For some schemes, double glazing is listed as a secondary measure. This means that if you would like double glazing installed through the Green Homes Grant, you will first need to apply for a primary measure (insulation or renewable heating). It’s also worth noting that these grants do not apply to triple glazing.

Other than the Green Homes Grant, there are very few schemes available and unless you're a pensioner, have a disability or are in receipt of certain benefits then it's unlikely that you'll be eligible. Some window grants include:

- Home Repair Assistance Grant

- Care & Repair

- Housing Aid for Older People Scheme

Other than the above, you may be able to apply for a home improvement grant through your local authority. All local authorities will have their own set of requirements for eligibility so you'll need to contact them directly.

We have more resources about double glazing grants that can help with window financing. If double glazing is too expensive and grants don’t apply to you, you can still opt for secondary glazing.

Which windows on finance options would be best for me?

There are many options when looking at finance for windows. The right one will primarily depend on what rate you can pay back, how much of a return on heating costs you can obtain, and the total cost of installation.

The best option can depend on the specifics, such as how much the current interest rate on loans is or the deposit amount. Flexible payments can be better when the interest rate is low, while interest-free credit with a low deposit can be the best option.

A surefire way to save money on installing new windows is to compare quotes. The numbers we list are averages but can vary based on many factors. To find out how much new windows cost, it's best to contact installers.

Using GreenMatch, you can get free quotes from up to 4 window installation companies in your area. By comparing quotes from multiple companies, you'll be in a position where you'll know that you're receiving a fair and competitive price. You can ask each installer about payment options – including windows on finance.

Click the button below to get 4 free, non-binding quotes now.

- Quotes from local engineers

- Payment by finance available

- Save up to £140 per year

It only takes 30 seconds

FAQ

Yes. Buying windows on finance can allow for more payment flexibility as there are many different plans available.

Getting windows on finance can be beneficial for many reasons, including payment flexibility and quicker installation.

The average cost of windows can be anywhere from £160 – £2,500. If that sounds expensive, you can spread the total out by getting windows on finance.

Rawal Ahmed is a writer at GreenMatch with an interest in sustainability and a background in tech journalism and digital marketing.

We strive to connect our customers with the right product and supplier. Would you like to be part of GreenMatch?

- Quotes from local engineers

- Payment by finance available

- Save up to £140 per year

It only takes 30 seconds