- GreenMatch

- Solar Energy

- Solar Panels

- Solar Panel Insurance

Solar Panel Insurance: Complete UK Guide for March 2025

Solar panel insurance is crucial for homeowners and businesses investing in renewable energy.

Imagine this: You've joined the green revolution by installing solar panels, enjoying lower electricity bills, and contributing to our planet.

Indeed, solar panels have become a staple in homes seeking sustainability and energy independence, offering the needed peace of mind and cost savings. However, the high cost of solar panels doesn't necessarily shield homeowners from the risks they must manage.

For example, what happens when a rogue baseball aims at your shiny new panels or Mother Nature throws a tantrum? In those cases, solar panel insurance can protect your investment from the unexpected.

Solar panel insurance shields homeowners from financial losses due to damage, theft, or other unforeseen events affecting their solar energy systems. Let's dive into solar panel insurance in the UK and see how it can keep your roof (and your bank account) happy.

Understanding solar panel insurance

Solar panel insurance doesn't only protect homeowners and businesses from various risks associated with solar panel installations and peace of mind. In the UK, solar panels are typically covered by home insurance policies.

The annual cost of solar panel home insurance ranges from £118 to £152, which seems reasonable compared to the potential risks.

Once you decide to install solar panels, inform your home insurer. Solar panels contribute to rebuilding your home's value, so it's important to list them in the insurance coverage.

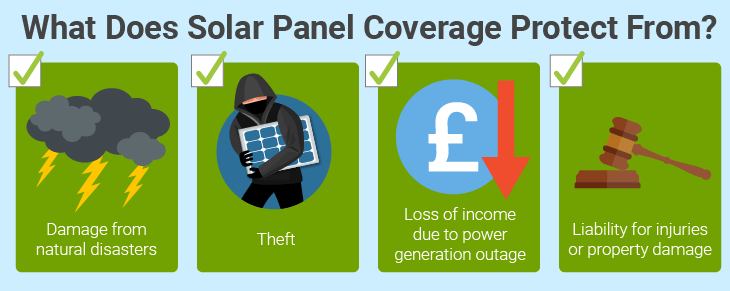

In general, solar panel coverage typically includes protection against:

- Damage from natural disasters: Renewable energy insurance commonly covers damage caused by natural disasters, including fire, hail, lightning, and storms. These events can pose a significant threat to the functionality of solar panels, and insurance helps mitigate the financial impact of such damages.

- Theft: Solar panels are valuable assets, making them potential targets for theft. Insurance policies often include coverage for stolen panels, ensuring that the policyholder is compensated for the loss and can replace or repair the stolen equipment.

- Loss of income due to power generation outage: In the event of a power generation outage caused by covered perils, solar panel insurance may provide coverage for the loss of income. This aspect is particularly important for businesses and homeowners relying on solar energy for daily operations.

- Liability for injuries or property damage: Solar panel insurance typically includes liability coverage, protecting the policyholder if the solar panels cause injuries or damage to other people's property. This coverage is crucial for safeguarding against potential legal claims and associated expenses.

For those seeking extra peace of mind, separate solar panel insurance policies, often with low premiums, are available to cover unexpected scenarios not included in standard home insurance policies.

Specialised insurance options also exist for the installation phase, protecting against financial losses due to accidents or damage during installation. These options include Public Liability Insurance, Personal Accident Insurance, and more.

Types of solar panel insurance policies in the UK

Solar panel insurance comes in various forms, tailored to different needs and installations:

- Standalone solar panel insurance: Specifically designed to cover solar PV systems

- Home insurance extensions: Additional coverage added to existing home insurance policies

- Commercial solar insurance: Policies for businesses with large-scale solar installations

Each type offers unique benefits and coverage options, protecting your solar investment against various risks.

What is not covered by solar panel insurance?

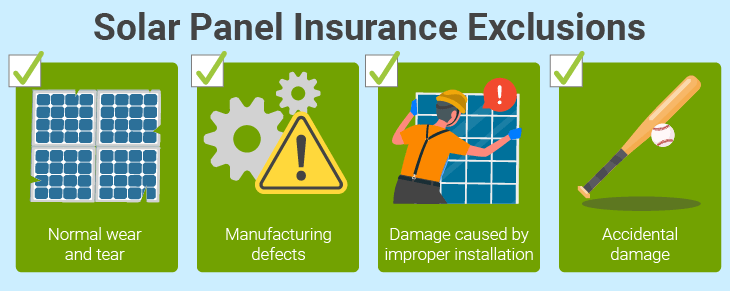

Despite the comprehensive nature of solar panel insurance, there are certain exclusions that policyholders should be aware of. These exclusions may include:

- Normal wear and tear: Solar panels are exposed to various environmental conditions over time, leading to natural wear and tear. Insurance policies generally don't cover the natural degradation of panels due to ageing, as this is considered a normal part of their lifecycle.

Look out for solar performance warranties, which guarantee 90% production after 10 years and 80% after 25 years. Yet, with solar panels' lifespans of around 25 years, they are likely to outlive the warranty.

- Manufacturing defects: Defects in manufacturing are typically covered by the manufacturer's warranty rather than solar panel insurance. Policyholders are encouraged to address manufacturing-related issues directly with the manufacturer or installer.

- Damage caused by improper installation: Solar panel insurance may exclude coverage for damages from improper installation. Policyholders must ensure qualified professionals install their solar panels to avoid potential issues that may void insurance coverage.

- Accidental damage: Solar panel insurance covers different risks, but it doesn't cover accidental damage. For an additional fee, you can add accidental coverage to your policy to provide extra protection for your solar panels.

Yet keep in mind that some insurances might not cover inverters. They usually last 10–15 years, which is less than the usual lifespan of solar panels. For instance, a homeowner in Cornwall faced £5,000 in repairs after a severe storm damaged their rooftop solar array. Their specialised solar insurance covered the full cost. Also, a Yorkshire farm had stolen ground-mounted solar panels, resulting in a £15,000 loss. Their comprehensive solar insurance policy provided full compensation.

This way, homeowners will need to replace at least two string inverters throughout the 25-year life of a solar panel system. Usually, the inverter replacement costs between £1000–£2000 each time, with any lost generated energy added.

Make sure you check whether your insurance covers solar inverter replacement. Alternatively, you will need separate insurance for a solar inverter.

This being said, always check with your insurance provider beforehand to determine what is and is not covered by your home or solar panel insurance.

Cost considerations for solar panel insurance

Several factors come into play when budgeting for solar panel insurance. Below is a detailed breakdown of the typical costs of insuring your solar panels and the variables influencing your premiums. This table provides insights on how to balance comprehensive coverage with affordable rates.

| Cost Factor | Typical Cost Range | Notes |

|---|---|---|

| Annual Home Insurance Premium Increase | £118 to £152 per year | Varies based on property value and coverage |

| Typical Solar Panel Insurance Cost | £400 to £1,600 (one-time) | Depends on system size and coverage |

| Solar Insure Coverage | ~£0.10 per watt installed | Varies with installer, equipment, and coverage package |

| String Inverter Replacement | £1,000 to £2,000 (every ~10 years) | Typically needed once per decade |

| Annual Maintenance and Repair | £150 to £350 per year | May be covered under warranty |

| Homeowner's Insurance Increase | £10 to £20 per month | Check with the insurance provider |

| Battery Storage (Optional) | £5,000 to £15,000 | Price decreasing, but still significant |

| Financing Costs (if applicable) | 3% to 7% interest | Depends on financing terms |

Solar panel warranties

Solar panels typically come with a 25-year warranty covering parts. However, they exclude damage from external factors like severe weather, where insurance plays a vital role.

These warranties are known as solar equipment and solar performance warranties.

| Warranty type | Solar equipment | Solar performance |

|---|---|---|

| Protection coverage | Guards against physical/hardware issues with solar panels | Ensures panels' performance, addressing an unacceptable stop |

| Duration | 10–12 years on average; may extend beyond 25 years | Time-limited; lifetime warranties possible |

| Compensation | Addresses physical failing and environmental issues | Offers compensation if performance guarantee isn't met |

| Output guarantee | Ensures a certain output level for the specified timeframe | Targets maintaining at least 90% of the original output after 10 years |

| Replacement coverage | Failing panels (varies by provider) | Provides compensation, potentially free replacement panels. |

It's worth noting that both warranties are generally transferable, meaning you can pass on the coverage to new owners when you sell your home. The manufacturer can also perform this automatically if you sell your property.

Yet these warranties typically protect against physical or hardware issues and performance drops but do not cover theft or natural disasters. It's important to understand that warranties aren't substitutes for insurance; they complement each other to provide comprehensive protection. Do your research before getting a separate solar insurance.

However, it's crucial to remember that every policy and situation is unique. Here are some additional points to consider:

- Increased dwelling coverage: While most policies include basic coverage for solar panels, their value might increase the overall value of your home. This could bump you into a higher dwelling coverage tier, potentially affecting your premium.

- Endorsements: Depending on your specific policy and the value of your solar panel system, you might need an endorsement to ensure sufficient coverage. This endorsement adds to your existing policy, specifically addressing the solar panels and offering additional protection.

If home insurance isn't possible, you could search for separate solar panel insurance from another provider.

It's always best to consult directly with your insurance provider to understand your specific coverage and any potential adjustments to ensure your solar panels are adequately protected. They can clarify if your current dwelling coverage is sufficient or if an endorsement is recommended.

UK solar panel insurance regulations and guidelines

Staying compliant with UK regulations is essential for solar panel owners:

- Microgeneration Certification Scheme (MCS): Ensures quality standards for solar installations

- Building Regulations: Specific requirements for roof-mounted solar panels

- Insurance Disclosure: Legal obligation to inform insurers about solar panel installations

Understanding these regulations helps in securing appropriate insurance coverage and maintaining compliance.

Homeowner's solar panel insurance

In most cases, your existing homeowner's insurance will cover your solar panels under your dwelling coverage. As a rule of thumb, they are classified as permanent fixtures for your house, like patios or security systems. This typically means installing them on the roof.

Panels mounted on the ground, a carport, or a detached shed aren't covered under standard dwelling coverage. In this case, depending on your insurer, you will need additional coverage or a separate policy.

Usually, homeowner's solar insurance packages cover all types of solar panels: monocrystalline, polycrystalline PV, or thin film solar panels.

The insurance protects your solar rooftop against common risks, such as fire, hail, lightning, storm damage, or theft.

The claim limit for solar panel coverage varies depending on the policy. In some cases, they can be set to 10% of the value of the dwelling coverage limit. Luckily for homeowners, most insurances don't have a set claim limit. This way, you can claim the full loss incurred in the event of solar system damage.

To avoid any misunderstandings, consult your insurer to adjust your policy.

Business owner's solar insurance

Businesses that install solar panels face unique challenges in ensuring adequate insurance coverage. Comprehensive commercial solar panel insurance protects the investment if a business owns the panels.

When solar panels are leased, the responsibility for insurance typically falls on the panel owner.

The next key point revolves around the heightened liability risks associated with commercial solar panel systems.

Given that these systems may be accessible to third parties or customers, the potential for accidents and damage increases. So, adequate liability insurance is essential to address these risks.

Lastly, it’s important to adjust the existing commercial property insurance policies. This involves discussing the value of solar panels with insurance agents, assessing overall coverage, and making necessary adjustments.

Ensuring comprehensive protection against theft, vandalism, lightning, and wind damage is crucial. A tailored and thorough commercial property insurance policy is necessary for financial security and peace of mind in the face of unforeseen events.

If your business heavily depends on solar panels, ensure you're protected with Business Interruption Insurance. It protects lost income if your business cannot operate due to unexpected events.

Home insurance vs specialised solar panel coverage: Making the right choice

Some home insurance policies may offer limited coverage for solar panels, but specialised solar panel insurance often provides more comprehensive protection. Compare the following aspects:

| Home Insurance | Specialised Solar Panel Insurance |

|---|---|

| May have lower coverage limits | Higher coverage limits tailored to system value |

| Might not cover all types of damage | Comprehensive coverage for various risks |

| Could affect home insurance premiums | Separate policy with potentially lower impact on home insurance |

Expert tips for negotiating better solar panel insurance rates

To potentially lower your insurance costs:

- Bundle policies with the same provider

- Increase your deductible

- Install additional security measures

- Provide proof of regular maintenance

- Ask about discounts for energy-efficient homes

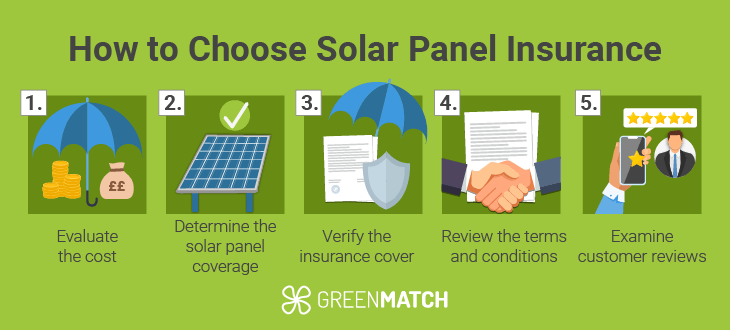

Choose the right solar panel insurance policy

If you're considering getting insurance for your solar panels, it's essential to dedicate time to finding the right provider.

Alternatively, if your home insurance includes coverage for solar panels, research whether your current insurer is the optimal choice.

Consider the following points when selecting the best solar insurance:

- Evaluate the insurance cost, or in the case of home insurance, understand how it may impact overall pricing and solar panel coverage.

- Determine if the insurance provides comprehensive protection for solar panels or if its coverage is limited.

- Verify whether the insurance will definitively cover your specific installation or the one you have in mind.

- Review the terms and conditions of choosing the ideal insurer for your needs.

- Examine customer reviews available on their website, social media, or other review platforms, including Google Reviews, to gather valuable insights.

All in all, securing proper solar panel insurance can provide peace of mind, knowing you're financially covered in case of such events.

While some basic coverage might be included in your existing home insurance, it's important to research and choose a plan that specifically addresses your needs.

Consider factors like loss of income coverage and ensure your sum insured reflects the value of your panels. By taking the time to understand your options, you can find a solar panel insurance plan that offers the right level of protection and alleviates the worry of potential financial burdens.

FAQ

Solar panel insurance commonly covers damages from natural disasters, theft, loss of income during power outages, and liability for injuries or property damage caused by the panels.

Exclusions may include normal wear and tear, manufacturing defects (covered by the manufacturer’s warranty), damages from improper installation, and accidental damage. Additional coverage may be needed for inverters.

In most cases, yes. Your existing homeowner’s insurance likely covers roof-mounted panels under dwelling coverage.

Most panels come with manufacturer equipment and performance warranties that cover physical issues and performance guarantees. These can be like a form of insurance.

To choose suitable renewable energy insurance, consider cost, coverage details, applicability to your installation, terms and conditions, customer reviews, and whether it meets your needs (e.g., loss of income).

We strive to connect our customers with the right product and supplier. Would you like to be part of GreenMatch?