Answer these simple questions and we will find you the BEST prices

Which type of solar quotes do you need?

It only takes 30 seconds

100% free with no obligation

Get up to 4 quotes by filling in only 1 quick form

Slash your energy bills by installing solar panels

For the average 2-3 bedroom house

Solar Panel Finance in The UK: Options in April 2025

- Solar panel financing is a means of investing in solar panels by paying for your system in instalments over an established amount of time (usually between several months and up to 20 years).

- The most common solar panel finance options include monthly payment subscriptions, financing through solar installation companies, taking out personal loans, and making use of government grants and schemes.

- Solar panel financing can be a good fit for you if you want to reap the benefits of solar panels without paying a large upfront cost right away. However, solar finance options tend to involve interest rates, which may affect you significantly in the long run.

Even though solar panels cost less today than they did in the last few years, they are still quite the investment. Prices range anywhere between £2,500 - £10,500 and paying such large sums may not be easy for everyone. If you’re in the same situation, then you may want to consider the solar panel finance options available in the UK.

In this guide, we’ll provide you with an explanation of what solar panel finance means and discuss the different options in the UK, such as subscription-based payments, financing through installation companies, personal loans, and government grants. This way, you can make an informed decision about whether solar panel financing is the right choice for your household.

Whether you opt to pay for solar panels over time or immediately, you’ll need to work with a certified installer to set up your system. Looking for one on your own can drag on for hours on end. So why not avoid the hassle and simply fill in our 30-second form instead? This way, you’ll hear back from up to 4 accredited installers in no time!

- Quotes from local engineers

- Payment by finance available

- Save up to £1,110 per year

It only takes 30 seconds

What are the solar panel financing options?

The most common solar financing methods available in the UK are: subscription-based payments, taking out personal loans, and financing through solar panel installation companies. Additionally, there are some loans available as part of government grants and schemes for solar energy.

Before you decide to pay off your solar panels over time, it’s important to bear the following considerations in mind:

- Most financing options involve interest rates, which can result in higher costs than paying for your solar system immediately.

- Some manufacturers or installers require a deposit before granting solar panel finance.

- Depending on the payment plan you opt for, you can spread out the costs of a solar system across several months and up to 20 years.

Find out more about each financing option below:

Subscription-based payments

This solar financing option allows you to spread out the cost of your system across several instalments, so that you can avoid dealing with large upfront costs in one go. Subscription models vary in terms of the number of instalments you can pay.

Some payment plans can last up to a few months, while others can reach up to 20 years. The later the deadline, the lower the monthly payments. So, be mindful of how much you’re able to spend on a monthly basis before committing to a subscription plan.

There are several solar panel manufacturers and suppliers that offer subscription-based payments. For instance, companies such as Renogy, Tesla, and LG Solar all provide the option to pay for your solar energy solutions in instalments.

While subscription models offer the advantage of not having to worry about a large upfront investment, the payments can increase over time. So, before opting to finance your solar panels through subscription-based payments, be sure to consider how they will impact your expenses in the long run.

Financing through solar panel installation companies

Some solar panel installation companies in the UK also offer financing options. In most cases, they will require a down payment before you pay the rest of the instalments (typically on a monthly basis). So, be sure to check whether the initial costs are financially feasible for you.

It may also be possible to include regular maintenance when you finance your solar panels through an installation company. This can be beneficial in the long run, as you’re guaranteed solar panel servicing from some of the best solar panel installers when needed, allowing you to fully enjoy your system.

As with the previous options, the importance of checking interest rates cannot be overstated. Be sure to consult with the installer you choose to work with to avoid overspending on your solar panels.

Personal loans

Another way to avoid paying the high costs of solar panels out of pocket in one go is by taking out a loan from a bank or other financial institutions. The payback period of the loan varies per bank, so be sure to consult with an expert to determine the exact duration.

As you may already know, obtaining a loan is highly dependent on your credit score, so a solar panel loan is only possible if your credit is deemed suitable for the amount you’re looking to borrow.

At the same time, personal loans involve interest rates that can add up significantly over time. Before making any decisions, be sure to carefully calculate how much you’d be spending to determine whether it’s worth investing in a solar system with a loan.

Government grants and schemes

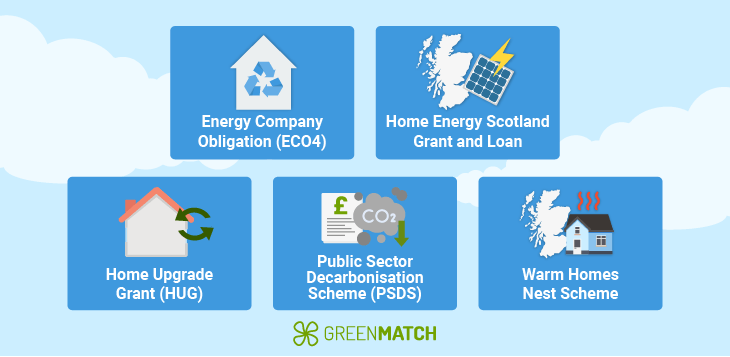

There are currently several solar panel grants and schemes available in the UK. These are meant to ease the financial burden for homeowners looking to transition to renewable energy systems. Currently, eligible homeowners can apply for the following solar panel funding options:

- Energy Company Obligation (ECO4): Applicants can receive partial or full funding for a new solar panel installation if they are part of a low-income household.

- Home Energy Scotland Grant and Loan: Homeowners based in Scotland can apply to receive up to £6,000 to fund their solar panel installation. This amount can be received as a grant of £1,250 and an optional loan of £4,750.

- Home Upgrade Grant (HUG): Those who apply can receive up to £10,000. However, the exact amount is regionally-dependent and varies per property type and the performance rating of existing energy systems.

- Public Sector Decarbonisation Scheme (PSDS): The amount of funding homeowners can receive through this scheme depends primarily on the region in which they are based.

- Warm Homes Nest Scheme: Applicants living in Wales can receive partial or full funding for installing a solar system.

No clue whether any of these options are a good fit? Then it’s best to consult a solar expert who can offer you tailored advice. Luckily, you don’t need to look for one on your own. Just click below to fill in our 30-second form and we’ll put you in touch with up to 4 solar panel installers from our network in no time!

- Quotes from local engineers

- Payment by finance available

- Save up to £1,110 per year

It only takes 30 seconds

How much does solar panel financing cost?

Today, the best solar panels on the market cost anywhere around £2,500 - £10,500, depending on the system size you require. If you choose to divide this cost into instalments, you’ll need to account for the fact that your subscription model or loan will involve an interest rate.

Interest rates vary depending on the installation company or financial institution you work with, but, generally, the APR (Annual Percentage Rate) involved ranges from around 9.9% to 14.9%. However, in some cases, the rate may even be 0%.

So, what does this mean for you and how does it compare to paying for your solar system immediately? You can check out the table below for an example of how much your interest adds up over time if you invest in solar panels for a large household:

| Subscription Provider | Loan Amount | Interest Rate (APR) | Payment Period | Estimated Monthly Payment | Estimated Loan Cost | Estimated Amount to Repay |

|---|---|---|---|---|---|---|

| Heatable | £11,295 | 9.9% | 10 years | £146 | £6,228 | £17,523 |

| Effective Home | £10,000 | 11.9% | 10 years | £140 | £6,728 | £16,728 |

| Green Central | £10,000 | 13.9% | 15 years | £130 | £12,876 | £22,876 |

As you can see, the interest rate significantly affects your expenses in the long run. Whereas the estimated cost of a solar system for a large household is around £9,500 - £10,500 if paid immediately, you’d spend around £16,728 in total with solar financing (with an average interest rate of 11.9%).

Overall, while it may be appealing to divide the cost of a solar system into smaller instalments, you may find yourself having a much higher total cost by the end of your payback period than you would by settling the cost upfront.

Is solar panel financing the correct decision for you?

Now that you know more about solar financing, you’re probably wondering: Are solar panels worth it with different financing options? If you’re looking to transition to renewable energy and enjoy yearly savings of up to £1,110 on your energy bills without breaking the bank, then, yes, solar panel financing may be the right choice for you.

That said, while spreading out the cost of solar panels over a few months or years has several appealing advantages, there are also some serious financial drawbacks to doing so. Overall, you would end up paying more for your solar panels over time than you would by covering the upfront cost of a new solar system right away.

So, before investing in solar panels, it’s crucial to weigh the pros and cons of solar financing against those of paying for your system in one go. If you’re having trouble figuring out the exact numbers on your own, you should consult a specialist who can offer you tailored advice.

Fortunately, you don’t have to look for a reliable expert any further. We work with a broad network of specialists and can connect you with up to 4 of them in no time. Then, just compare them to find the best fit for your needs. Simply click below to get started now - it’s quick, easy, and completely free!

- Quotes from local engineers

- Payment by finance available

- Save up to £1,110 per year

It only takes 30 seconds

FAQ

Yes, it’s possible to finance your solar panels in the UK. In fact, there are multiple financing options available, such as taking out a loan, paying for your system through subscription models, or financing your solar panels through an installation company.

Yes, some companies offer interest-free solar panel financing. However, most financial institutions or installation companies will include interest rates in their financing models, which can significantly impact your expenses over time.

Sabria Schouten is a content writer who aims to make information about sustainable energy broadly available. She believes that knowledge about how to lead a greener lifestyle should be easily accessible to anyone.

We strive to connect our customers with the right product and supplier. Would you like to be part of GreenMatch?