Answer these simple questions and we will find you the BEST prices

Which type of solar quotes do you need?

It only takes 30 seconds

100% free with no obligation

Get Free quotes from insulation specialists near you

Save money by comparing quotes and choosing the most competitive offer

The service is 100% free and with no obligation

- GreenMatch

- Insulation

Home Insulation in The UK - 2026 Guide

- A UK household can lose up to one-third of its total heat to poor insulation, equivalent to throwing away £1 for every £3 spent on heating.

- Insulating your walls, floor, and loft can save you £630 - £730 annually on energy bills.

- Home insulation can cut your annual CO2 emissions by 1.4 to 1.7 tonnes.

With energy prices skyrocketing across the UK, many homeowners are feeling the pinch. Yet surprisingly, the biggest culprit isn't always expensive fuel – it's poorly insulated homes.

Compared to neighbours in Europe, the UK housing market struggles with energy efficiency. A staggering 27% of the country's CO2 emissions come from domestic energy use alone. A 2022 study by the independent think tank Resolution Foundation (RF) also identified that poorly insulated UK homes burn 58% more gas annually for domestic heating compared to homes that meet government insulation standards. This makes the question of how to reduce heat loss in a house a priority for all households.

The good news? Proper home insulation stands as a highly effective and eco-friendly upgrade that all homeowners can benefit greatly from.

- Cavity wall insulation: Up to £485 per year

- Solid wall insulation: Up to £660 per year

- Floor insulation: Up to £135 per year

- Roof and loft insulation: Up to £445 per year

If you’re wondering how to save money on heating, this ultimate guide on home insulation advice in the UK is for you. We will discuss what complete home insulation entails, costs, available government grants, and the best insulation on the market.

Already eager to buy loft insulation to enjoy big savings and an eco-friendly home? Let GreenMatch UK free you from the burden of countless hours of research and vetting. Through our network of trusted installers right in your area, you could benefit from bargains and tailored quotes within 24 hours!

Simply fill out our 30-second form and receive up to 3 free quotes from trusted professional installers right in your area; completely free of charges and obligations. Click the button below to begin!

- Describe your needs

- Get free quotes

- Choose the best offer

It only takes 30 seconds

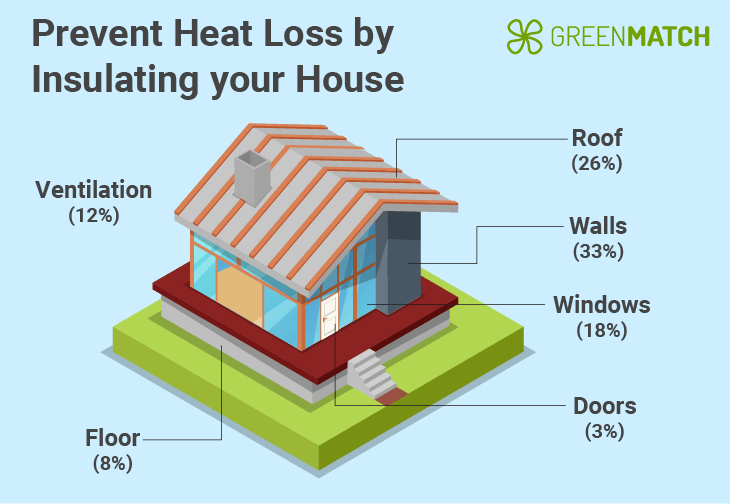

Prevent heat loss by insulating your house

To prevent heat loss in your house, it’s best to first identify where heat escapes from and understand the impact on both your expenses and the planet. The diagram below demonstrates the distribution of average heat loss in your house:

Walls and roofs alone account for almost two-thirds of the heat leaving your home. Single-glazed windows, draughty doors, and uninsulated piping also play a role in heat loss.

Poorly insulated homes not only hurt your savings but also contribute significantly to environmental issues. A staggering 27% of the UK’s total carbon emissions come directly from domestic energy supply, including home heating.

Addressing insulation gaps in your home and installing suitable insulation offers numerous benefits:

- Environmentally friendly: Effective insulation significantly reduces the need for heating fuel, helping decrease fuel reliance whilst combating climate change.

- Save money on your energy bills: Proper house insulation is one of the most impressive ways to save on energy bills. By retaining more heat, your energy system works less to compensate for heat loss.

- Increased home value: Insulating your home can boost its market value, thanks to improved EPC ratings. This enhances your investment while still reducing your monthly energy expenses.

Getting into contact with a local energy auditor is recommended, as they can analyse your insulation and recommend cost-saving improvements to keep your bills manageable and your home warm.

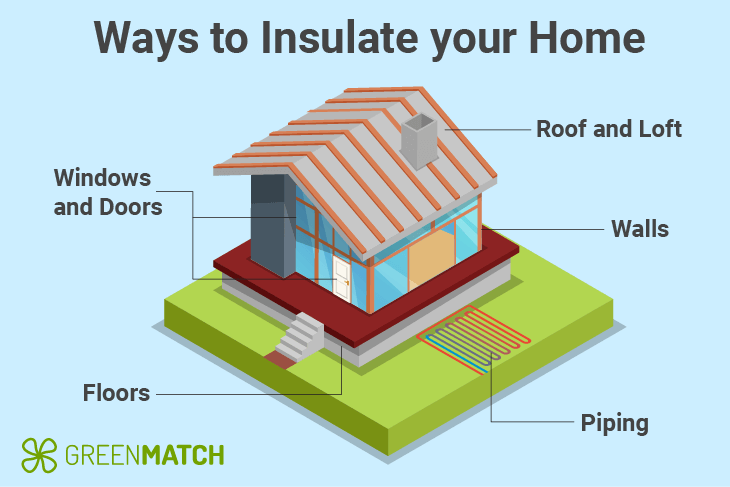

Ways to insulate your home

Implementing various insulation methods and heat-saving tips can enhance your property's ability to retain heat efficiently. These upgrades not only save on energy bills but also reduce your home's carbon footprint.

Here is a breakdown of the cost and saving expectations for each type of home insulation:

| Insulation type | Costs | Energy bill savings (£/year) | CO2 savings (kgCO2/year) |

|---|---|---|---|

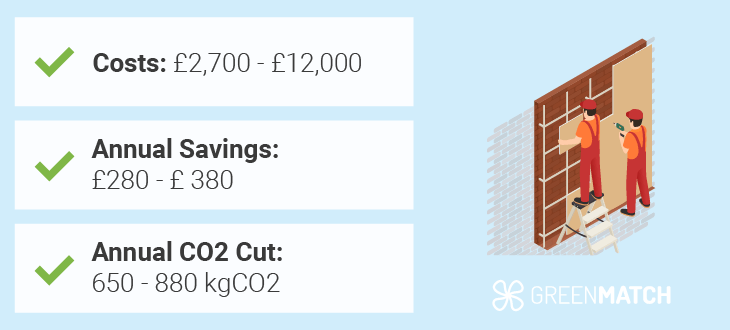

| Cavity wall (270mm) | £2,700 | £280 | 650 |

| Solid wall (internal) | £7,500 | £380 | 880 |

| Solid wall (external) | £12,000 | £380 | 880 |

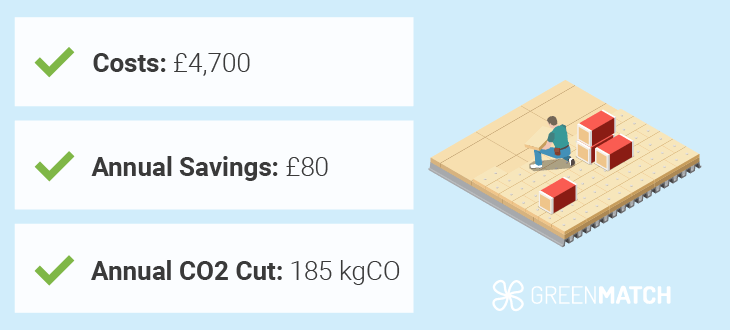

| Floor (suspended timber) | £4,700 | £80 | 185 |

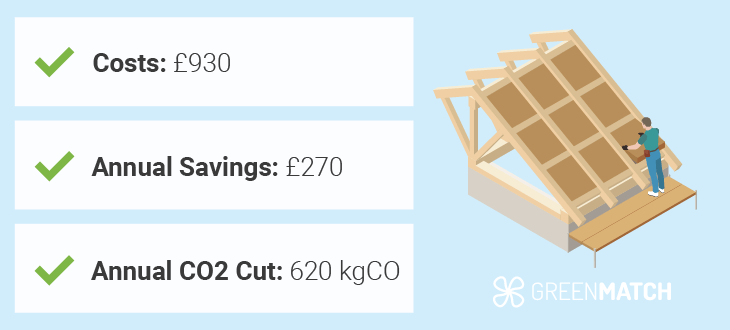

| Loft | £930 | £270 | 620 |

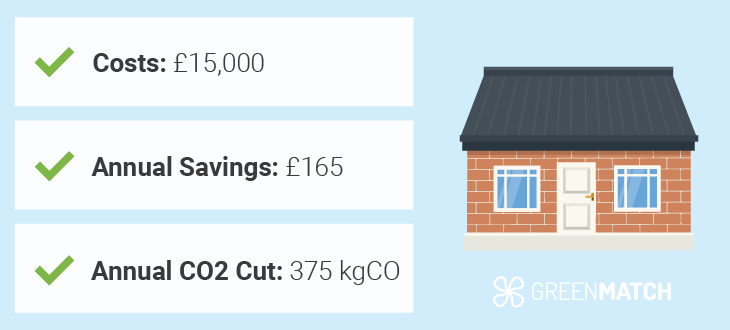

| Windows | < £15,000 | £165 | 375 |

| Doors | £840 – £4,325 | £45 | - |

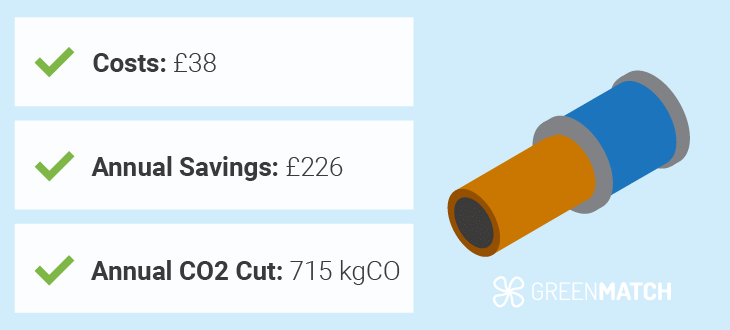

| Pipes & Water Tank | £38 | £226 | 715 |

Roof and loft insulation

Homes lose up to 26% of their heat just through uninsulated roofs. Insulating your loft, attic, or flat roof reduces heat loss, benefits the environment, and can cut your energy bills by up to £270 annually in a semi-detached home. Loft insulation costs for a 3-bed semi-detached UK home sit around £930, but those qualifying for a loft insulation grant can reduce these costs even further.

Roof insulation and loft insulation is not only effective in slashing energy bills but boasts a quick payback time of just over three years. This means it pays for itself many times over its 40-year lifespan.

Insulating your loft brings various benefits to your energy and financial security. It can potentially cut your annual CO2 emissions by up to 0.6 tonnes! Before you proceed with loft insulation, here are a few things to consider:

- Loft purpose: Determine whether your loft is for storage or living. This decision influences the type of insulation needed. If it's a living space, it is recommended to insulate the internal walls of the heated room to minimize heat loss. In either case, it's best to work with professional loft insulation installers for the best results.

- Dampness: If your loft suffers from dampness, insulation can worsen this problem significantly. It is highly recommended to solve dampness issues with a professional before you install any insulation.

- Ventilation: Whether a DIY or professional job, ensure that any vents, grills, or air bricks are not covered during installation to prevent dampness, mould, and rot down the line.

- Draught-proofing: For lofts with window openings, consider draught-proofing to help further reduce heat loss by ensuring less cold air gets in, and less hot air gets out.

If you're wondering how to save heat, insulating a loft can be done in several ways depending on your needs, including DIY. The main decision to make is whether your loft will be used as storage or living space. Here is how the process can differ for each choice:

- Loft for storage: For storage, loft floor insulation is sufficient to keep your home warm. This can be done DIY, but a professional is always recommended. Use 'loft legs' on the joists to elevate the floor, creating a wider gap. These can be found at most hardware stores. Add 270mm of mineral wool or another insulator, leaving a 50mm air gap for ventilation between the insulation and floorboards.

- Loft for living: For living spaces, a professional installer will be required to ensure compliance with regulations and proper installation. Alongside pitched roof insulation, the walls and ceilings between the heated living space and unheated loft spaces will have to be insulated. Loft living spaces with windows or skylights will also need quality glazing for optimal insulation.

The best loft insulation material will depend on a series of factors, such as your loft type, available budget and personal preferences.

Insulating a flat roof must be carried out by a professional, as it requires insulating from above. Normally, rigid boards of insulation are laid across the outer roof of your home - either directly on the existing weatherproof layer or on the rafters under it - with a new weatherproof layer added on top. Given the nature of this installation, it is recommended to start when your roof covering needs replacing to save yourself the hassle. A roof insulation cost can vary significantly depending on your property type, installation complexity and personal preferences.

Flat roof insulation can also be done from the inside ceiling, but this style of insulation is much more prone to dampness and condensation problems if not installed properly, therefore less popular than insulating from the outside.

The Great British Insulation Scheme offers help with loft and roof insulation costs. If you find these prices overwhelming, here’s good news: you might qualify for this government initiative (formerly ECO+). The aim is to assist the least energy-efficient homes in the UK, addressing fuel poverty and cutting energy bills.

Starting in April 2023 and running until March 2026, eligible participants can get reduced cost, or free insulation based on a property assessment.

Floor insulation

An average household can lose up to 8% of its heat through uninsulated floors. Floor insulation is an effective way to enhance heat preservation in your home, saving you up to £80 on your annual energy bills. You normally only need to insulate the ground floor, even in properties with multiple floors.

To know which type of insulation works best, you must first identify the type of floor you have:

- Concrete floor: Common in new UK homes, these floors can be insulated when in need of replacement/repair, or can easily accommodate rigid insulation panels on top, concealed with flooring material. Concrete floor insulation tends to cost more than suspended timber floors.

- Suspended timber floor: More common in older UK homes, these are normally made of timber floorboards attached to joists that sit just above the foundations of a house. This creates a small gap under the floor, allowing for ventilation to prevent the floorboards from rotting. This is also commonly called underfloor insulation.

Suspended timber floors are often identified by ventilation bricks that can be seen on the outside walls of your home, just below floor level. If you have a cellar beneath your house, you could also go down and likely see the wooden joists and floorboard undersides.

Timber floors are insulated by lifting the floorboards and laying mineral wool fibre insulation between the joists. The insulating material is then secured in place by netting, and the floorboards are placed back on top.

Insulating suspended timber floors can be done by yourself as a DIY project (more on this later), but it is still highly recommended to work with a professional licensed installer to make sure the job is done correctly and up to insulation building regulations.

Wall insulation

Poor wall insulation can result in up to 33% of heat loss in your home. The UK typically has two common types of outer walls used in home and building insulation: cavity walls and solid walls. Both can be insulated to improve heat retention, leading to annual energy savings of £280 - £380 respectively.

- Cavity walls: Commonly found in homes built post-1920, these are made of two walls with a small inner gap called the ‘cavity’. The outer layer is usually made of brick and the inner layer of concrete block. Up to 28% of cavity wall properties in the UK lack proper insulation and risk significant heat loss.

- Solid walls: Far more common with pre-1920 homes, and consist of single-layer brick walls with no cavity in between. A shocking 97% of solid wall properties in the UK lack proper insulation and experience unnecessarily high energy bills as a result.

Cavity wall insulation, usually completed within a few hours, is a relatively straightforward process that involves a licensed professional injecting insulation material into the cavity through small holes drilled in the outer wall. Once done, the holes are sealed with cement and become hardly visible.

Solid wall insulation is a different process. Since there is no cavity, solid walls can only be insulated internally or externally. This process tends to be more labor-demanding and expensive to carry out. The main differences are as follows:

- Internal insulation is done by fitting solid insulation boards on the inside walls of your home, or through stud wall insulation, in which a plasterboard wall is built within the property and filled with insulation material such as mineral wool fibre. Internal insulation tends to be cheaper to install, but will slightly reduce your floor space.

- External insulation is when insulation material is fixed to the outer walls of your home and then covered in plasterwork or insulation cladding. Benefits include enhanced weatherproofing, sound isolation, and an undisturbed home during installation. Planning permission may be required due to alterations in the home's outer appearance. An external wall insulation cost tends to be higher than an internal wall.

Windows & Doors

Inefficient windows and doors can harm your home's energy efficiency, accounting for around 18% of your home's heat loss. Double-glazed windows can cut heat loss by over 30%, saving up to £165 on your annual energy bills, while reducing your home's carbon footprint. Combined with insulated doors, you can see annual savings up to £210.

Double or triple-glazed windows are windows with two or three panes of glass in a single unit, with pockets of air or gas (such as argon or xenon) in between. Alongside improved insulation, these windows come with a wealth of other benefits for your home.

- Less condensation: Energy-efficient glazing reduces moisture transfer into your home, preventing structural damage and mold in the long run.

- Noise reduction: Air gaps between panes act as an effective noise insulator, creating a quieter home, especially useful in urban areas.

- Enhanced security: Thicker windows and more robust window frames provide an added layer of security, reducing the risk of break-ins.

Insulating and draught-proofing your doors can further prevent heat from escaping your home. Most modern doors now meet energy efficiency regulations with integrated insulation layers directly in the door. Prices can vary over a wide range depending on dimensions, material, and style, but there is an option for every budget.

For existing doors, here are some simple ways you can reduce draught:

- Side panel gaps: For existing doors with panel gaps on the side and bottom of your door, use external draught-proofing strips to seal these openings and further reduce heat loss. These can be found in most local hardware stores.

- Bottom gap: Purchasing a brush, similar to in a letterbox, or a draught excluder strip can help seal this gap and better prevent draught.

- Keyhole: It may seem so simple, but attaching a purpose-made keyhole cover – usually a metal disc – can help better seal the keyhole opening.

- Letterbox flap: Attaching a draught-proof strip to seal the gap of your letterbox, or buying a letterbox flap with a brush attached can minimise heat loss.

Internal doors will only need draught-proofing if they lead to an unheated portion of your home. In this case, the same simple methods mentioned above can be applied.

Piping insulation

If you want to go the extra mile, insulating your ventilation shafts, radiators, water tank, and piping is an easy and cost-effective way to boost energy efficiency in your home, and reduce up to 12% of heat loss. These combined insulation upgrades can save up to £226 on your annual energy bills.

- Radiators: Placing reflector panels behind your radiators can help retain more heat in your home. These low-cost panels reflect heat into the room, preventing heat loss through external walls.

- Water tank: Putting a hot water cylinder jacket on your water tank will make sure your hot water stays at a high temperature for longer. Cylinder jackets cost as little as £20 and can be fitted by yourself with the provided instructions.

- Pipes: In winter, your pipes - especially outdoors - will be exposed to colder temperatures, resulting in heat loss and even freezing over. To prevent this, there are several tube-shaped insulators made from polyethylene foam, rubber, or foil tape that can easily be cut and wrapped around these pipes for added efficiency.

Best insulation materials

The best insulation material usually depends on the job at hand. If you plan to insulate cavity walls, mineral wool insulation is a sustainable and affordable choice that is commonly used for the job. The versatility of shapes - coming in sheets and batts - easily slides into wall cavities, can be tightly packed, and cut into the desired length with ease. Mineral wool is also one of the easiest materials to dispose of sustainably due to its recyclability.

In any case, choosing ‘the best’ insulation material is largely subjective, and the ideal choice will depend on your property type, budget, and efficiency requirements.

Here's a brief overview of the traditionally used insulation materials in UK homes:

- Fiberglass: A popular thermal insulation choice used mainly for loft, roof, floor, or internal wall insulation. Made from recycled glass fragments and sand, fibreglass insulation usually comes in blankets or sheets. Its soft malleable structure makes it an ideal material to work with, especially with irregular shapes and hard-to-reach areas such as in attic insulation.

- Polyurethane (PUR): A highly effective insulating foam that is especially great for filling small cracks and crevices in roof and floor insulation. It is applied using a spray gun and is commonly used as a cavity wall insulator.

- Polystyrene: A rigid thermoplastic foam that excels in heat and noise insulation. Available as expanded (EPS) or extruded (XEPS) foam, with the former having less density than the latter, it comes in sheets or blocks that are normally used in wall insulation.

- PIR Board: Short for Polyisocyanurate, this polymer-based insulator is melt-proof and comes in rigid boards or panels. PIR boards are commonly used for ceiling insulation, floors, and walls. It may not be the cheapest insulation, but is highly effective in retaining heat.

Here is a summary of the r-value, u-value, and average costs for each insulation material to give you a good idea of what to expect:

| Insulation material | R-value (m²K/W) | U-value (W/m²K) | Average cost (per m2) |

|---|---|---|---|

| Fibreglass | - | - | £10 |

| Polyurethane | 3.6 - 4.5 | 0.022 - 0.028 | £21.5 |

| Polystyrene (EPS) | 2.6 - 3.3 | 0.030 - 0.038 | £10 |

| PIR Board | 3.6 - 4.5 | 0.022 - 0.028 | £5 – £15 |

Eco-friendly insulation materials

There are also plenty of eco-friendly and sustainable insulation material alternatives that are good both for your health and the planet. Natural insulation materials have started gaining popularity in the UK and worldwide for their health-conscious qualities.

- Recyclable: Most of these materials derive directly from nature, are biodegradable, and can be reused or disposed of sustainably, unlike traditional synthetic insulation materials that often end up in landfills for centuries to come.

- Healthier: Natural insulators don’t run the risk of secreting harmful chemicals or volatile organic compounds (VOCs) into your home, promoting better air quality.

- Great performance: Many natural insulators match the insulating performance of synthetic materials in preventing heat loss in a house, often exceeding expectations.

Here are some common and emerging natural options for eco-friendly insulation:

- Mineral Wool: Spun yarn made from melted glass (glass wool) or stone (rock wool) and threaded together to form woolly sheets or batts. It’s commonly used to insulate interior and exterior walls, floors, and roofs, and can also be blown into small crevices, much like foam or cellulose.

- Sheep's wool: 100% natural wool made from sheep’s wool clippings, used in wall, floor, and roof insulation. The naturally crimped texture of sheep's wool makes it highly effective in slowing heat transfer. It is also a reliable, renewable, and sustainable alternative to traditional synthetic insulators.

- Cellulose: An eco-friendly and highly effective material used to prevent heat loss in roof and wall cavities. Made entirely from recycled paper products and more efficient than fibreglass, the cellulose is broken down into very tiny powder-like fragments, which are converted into a fibre that can be blown into small spaces and crevices.

- Perlite: A volcanic mineral that is processed with minimal environmental impact, yet incredibly versatile for year-round heat insulation. When heated, perlite expands up to 16 times its original volume, making it extremely useful, especially as cavity wall insulation.

- Denim: Also known as blue jean insulation, it is made from recycled denim products and has high thermal efficiency. Deriving from a natural material, cotton, denim insulation is an environmentally conscious choice that also helps reduce textile pollution.

| Insulation material | R-value (m²K/W) | U-value (W/m²K) | Average cost (per m2) |

|---|---|---|---|

| Mineral Wool (Glass) | 2.5 - 3.3 | 0.030 - 0.040 | £13 - £17.5 |

| Sheep's wool | 3.5 - 4.5 | 0.22 - 0.29 | £17.5 - £22 |

| Cellulose | 2.4 - 2.8 | 0.036 - 0.042 | £10 - £12 |

| Perlite | - | - | - |

| Blue jean insulation | - | - | - |

R-value / U-value

When reading about the insulation capacity of different materials, you will often come across the two terms R-value and U-value, here is the difference:

- The R-value tells us how well a material can resist the transfer of heat. It is a score given to a ‘barrier’ based on how well it can stop heat from travelling through it.

- The U-value on the other hand tells us how quickly a material allows the transfer of heat through it. It can be considered the opposite of the R-value in some senses.

So if the R-value is concerned with the resistance of a surface, the U-value is then concerned with the transmittance of a surface. But is one value more important than the other? What is considered a good score?

The scoring of the R-value can range on a scale from 0 to 66. A higher score means a better ‘resistance’ to heat transfer. On the other hand, U-value scores usually range from 0.1 to 1. The lower the U-value the better, as it indicates a slower ‘transmission’ of heat.

Cost of insulating your house

The cost of insulating a house will be £12,930 for a 3-bedroom semi-detached house in the UK. - including cavity walls and roof or loft. The cost of insulation can also vary depending on your specific home, type of insulating material, and job complexity amongst other factors.

If you’re focused on wall insulation alone, cavity walls can cost up to £2700, while solid walls may run around £7,500 for internal wall insulation, and £12,000 for external wall insulation. Keep in mind that prices can vary based on your home's specifications, chosen insulation material, and installation complexity.

With cavity wall and loft insulation, you can cut up to two-thirds of home heat loss, leading to potential annual energy bill savings of up to £550. Additionally, this can boost your property's market value, providing a much higher return on investment in the future.

Proper home insulation not only saves you money but also reduces your home's carbon footprint by an impressive 1.27 tonnes per year. Home insulation is a wise investment that safeguards your savings, enhances property value, and contributes positively to the environment.

Ready to get your home insulated? While these prices may seem steep, the key to the best bargain is to work with a quality professional installer within your budget. This is easier said than done and can have you marred in hours of endless website and phone call research. Here at GreenMatch UK, we can solve this problem for you at the click of a button.

Simply fill out our 30-second online form and benefit from 3 free quotes from our network of trusted local installers. Get ahead of the market prices with home-specific tailored quotes at no hidden charges or obligations. Click the button below to begin!

- Describe your needs

- Get free quotes

- Choose the best offer

It only takes 30 seconds

Hiring a professional insulation company

When it comes to home insulation, the cost is just one factor to consider as selecting the right company is also a crucial step. Accredited professional installers ensure compliance with regulations and guarantee a professional job that will keep your home insulated for decades.

However, vetting for reliable installers can be an arduous task in itself. To help ensure you make the best decision for your home, here are some key pointers to look out for:

- Grant eligibility: Before contacting any tradespeople or installers for a quote, find out if you are eligible to benefit from any government grants (more on this later). The Great British Insulation Scheme and the ECO4 scheme are two active government initiatives that help low-efficiency and low-income homes upgrade their insulation.

- PAS 2030 compliance: If you're eligible for a government grant, choose an insulation specialist with PAS 2030/2035 approval, a standard set by the government for grant-specific installers. This indicates professionalism, even if you don't qualify for a grant.

- Installer qualifications: Certain types of insulation - especially exterior - will require planning permission and regulation approval. Therefore, it’s a good idea to ask insulation companies if they are a member of a competent person scheme related to insulation. Some examples of these schemes in the UK are CIGA, or Stroma.

Additionally, get multiple quotes from different installers to get a well-rounded understanding of your expected costs. Beware of pushy sales reps asking for upfront payments on the first meeting; they might be unprofessional or part of a scam.

Insulating your house by yourself

If you enjoy DIY projects and want to save money, you can tackle some house insulation tasks without hiring a professional. However, certain jobs do legally require professional installers.

Some home insulation projects that you can do DIY include:

- Loft insulation: If your loft is structurally sound, lift the floorboards and lay rolls of mineral wool in between the joists. Then, add another layer at a right angle, covering the joists, and place the floorboards back on top. Use 270mm of mineral wool and leave a 50mm air gap between the wool and floorboards for ventilation. Consider using ‘loft legs’ from a hardware store to raise the floorboards to create the space. Avoid covering existing ventilation during this process.

- Floor insulation: You can insulate your floor yourself if you have suspended timber floors. Lift the floorboards, lay 270mm of mineral wool between the joists, and secure them with netting before putting back the floorboards. Make sure to not compress the mineral wool with the netting as this will minimise its insulating capacity.

- Draught-proof windows and doors: Use adhesive draught-proofing strips or metal/brush-based strips to minimize draughts in panel gaps. You can purchase draught-proofing covers for various openings, such as keyholes and chimneys, all of which can be found in your local hardware store.

- Draught-proof walls and floors: Fill the cracks in floorboards, walls, and around windows and doors with silicone-based flexible fillers or mastic-type products. These are available at most hardware stores, often with an applicator gun for easy use.

While avoiding professional installation costs may be tempting, faulty self-installation can lead to greater financial harm in the long run. Synthetic insulation materials like fibreglass, mineral wool, or insulation foam can be hazardous if mishandled and outright toxic if inhaled or ingested.

To ensure the job is done correctly and to avoid future issues and unexpected costs, it's advisable to work with a licensed installer who follows recommended regulations and maintains a professional standard.

Insulation grants in the UK

In a bid to go carbon neutral, the UK has rolled out a series of grants and schemes, such as wall and loft insulation grants, aimed at assisting low-efficiency and low-income households throughout the country with improving their energy efficiency.

If you qualify for any of these schemes, chances are you can receive partial or complete coverage for your home insulation upgrades. The current active schemes are as follows.

The Great British Insulation scheme

The Great British Insulation Scheme, administered by Ofgem, aims to provide insulation improvements to the least energy-efficient homes throughout the UK. The goal is to help tackle fuel poverty in the face of rising costs while also reducing overall carbon emissions.

The Great British Insulation Scheme mostly delivers a single insulation measure per household to be able to reach more homes in the long run. The scheme targets people on the lowest incomes (low-income group) and those with lower Council Tax band homes (general group).

Both groups are eligible for a series of insulation improvements:

- Cavity walls (including party wall)

- Solid walls

- Lofts

- Pitched roofs

- Flat roofs

- Under-floors

- Solid floors

- Park homes

- Rooms in loft

ECO4

There is also the Energy Company Obligation (ECO4) scheme, which provides grants to fund energy-efficient home upgrades aimed at reducing carbon emissions, energy use, and fuel poverty throughout the UK.

ECO4 is designed to assist households that are considered to be in fuel poverty. The scheme works by placing a Home Heating Cost Reduction Obligation (HHCRO) on medium to large energy suppliers.

Under this obligation, suppliers must provide measures to low-income and fuel-poor households to improve their means of accessing efficient heating. This can include measures such as heating systems, but also complete and partial home insulation.

Ready to upgrade your home's energy efficiency with quality insulation? Finding the right installer would be the next step. Nevertheless, sifting through endless websites and phone calls can have you waste weeks on end with no clear direction in sight. That's where GreenMatch UK comes in.

Simply fill out our 30-second form to receive 3 free quotes, tailored to your home and specific needs. Best part? Our services are completely free of charges and obligations. Benefit today from our trusted network of professional installers right in your area. Click the button below to begin!

- Describe your needs

- Get free quotes

- Choose the best offer

It only takes 30 seconds

FAQ

There are some forms of DIY home insulation – mainly loft and floor – which you can carry out yourself by placing mineral wool insulation sheets between the joists and floorboards. You can also draught-proof many of your doors and windows with adhesive draught-proof strips and silicone fillers available in most hardware stores.

Insulating your home comes with numerous benefits. Insulation will drastically reduce your annual energy bills by ensuring less heat escapes your home. This way, your heating system isn’t working as hard to maintain the internal temperature. Insulated homes also have higher property values in the housing market. It also significantly reduces your carbon footprint, benefitting the environment at large.

Houses are insulated in many different ways depending on the job at hand. Cavity wall insulation is a common example, in which the gap or ‘cavity’ between a property’s inner and outer wall is filled with insulating material. This process can see your home reduce up to 33% of heat loss.

There are several natural insulation materials available for home insulation. Sheep’s wool is an eco-friendly alternative to mineral wool for insulating floors, walls, and lofts. Cellulose is another sustainable alternative made from recycled paper products commonly used in roof and wall cavity insulation.

Akif is a copywriter at GreenMatch since 2023. With a keen interest in community sustainability, green solutions and the role of digital media in identifying climate trends, he aims to hone in on his background in International Studies and Digital Media to provide a multidisciplinary approach to written content rooted in credible research and accuracy.

We strive to connect our customers with the right product and supplier. Would you like to be part of GreenMatch?