Answer these simple questions and we will find you the BEST prices

Which type of solar quotes do you need?

It only takes 30 seconds

100% free with no obligation

Get up to 4 quotes by filling in only 1 quick form

Install a heat pump for less with the BUS grant

We’ve helped over 500,000 homeowners reduce their carbon footprint

- GreenMatch

- Heat Pumps

- Heat Pump Statistics 2025

Heat Pump Statistics 2025: Market Size, Trends, and Predictions

Heat pumps are increasingly popular because they provide efficient heating and cooling for homes and businesses. But what do the statistics say about this remarkable heat pump?

As sustainable living gains momentum, the heat pump industry continues to evolve. The upcoming Heat Pump Statistics report for 2024 provides exclusive insights into the market size, emerging trends, and future predictions.

This comprehensive analysis explores the growing adoption of heat pumps in residential and commercial sectors, shedding light on key factors driving market expansion.

Now that we better understand heat pumps let's examine some statistical facts highlighting their advantages and impact on energy consumption.

Global heat pump statistics for 2024

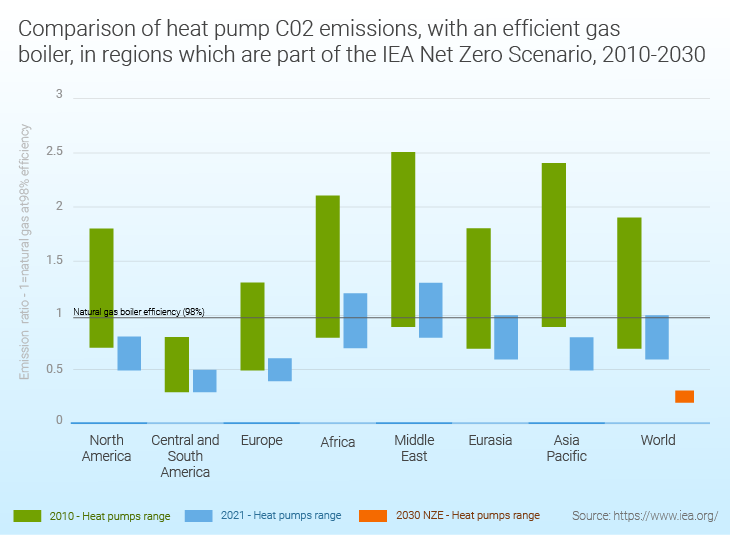

The global heat pump market is experiencing significant growth, with various types of heat pumps gaining traction due to their energy efficiency and potential to reduce carbon emissions.

Heat pumps are three to five times more energy-efficient than natural gas boilers, reducing households' exposure to fossil fuel costs.

Due to its environmental friendliness, this technology provides up to 70-80% of an average heat pump's energy from renewable sources. This growth is driven by increased policy support and incentives for heat pumps in light of high natural gas prices and efforts to reduce greenhouse gas emissions. For instance, the UK's Boiler Upgrade Scheme provides grants to homeowners who are installing heat pumps.

Heat pumps cover around 10% of current heating needs as a primary device. This corresponds to over 100 million households, meaning that one in ten homes that require substantial heating is served by heat pumps today. The Asia-Pacific region was the largest heat pump market in 2023, valued at £90.5 billion.

To align with national energy and climate pledges worldwide, heat pumps must meet nearly 20% of global heating needs in buildings by 2030.

Here are some statistical facts about heat pumps based on the author's analysis and IEA:

- Global sales of heat pumps grew by 11% in 2022, marking a second year of double-digit growth.

- The global heat pump market size was estimated at £59.68 billion in 2022 and is expected to grow at a CAGR of 9.3% from 2023 to 2030.

- Heat pumps have a coefficient of performance (COP) of around four, making them 3-5 times more energy efficient than gas boilers.

- Ground-source heat pumps have a Coefficient of Performance (CoP) of 4.8, higher than the CoP of air-source heat pumps.

- Water source heat pumps provide high efficiency with a coefficient of performance (COP) of around 5.

- The heat pump segment with up to 10 kW capacity accounted for a market share of 14.7% in terms of revenue.

- Most heat pumps with 10-20 kW capacity provide quiet operation, are environment-friendly, and offer high efficiency.

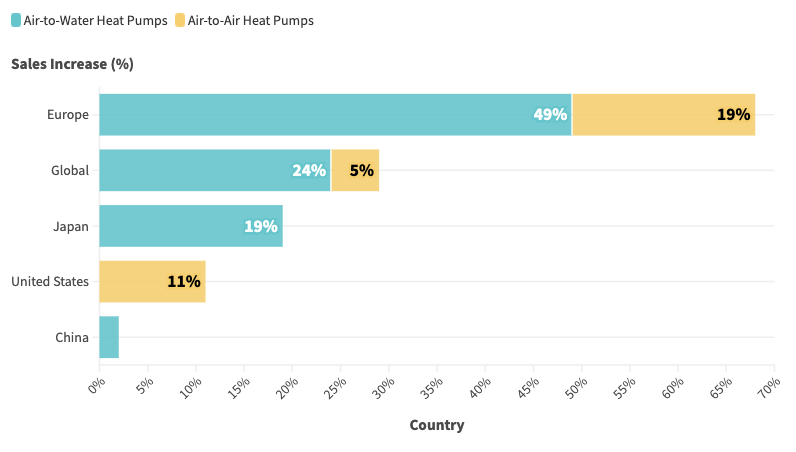

- In Europe, heat pump sales grew by nearly 40% in 2022, with air-to-water models seeing a jump of almost 50%.

- The global industrial heat pump market reached approximately £6.9 billion in 2023 and is projected to grow at a CAGR of 7.20% between 2024 and 2032.

- Globally, 177 million heat pumps have been installed. China (33%) had the most installations, followed by North America (23%) and Europe (25%).

- Global heat pump supply and installation could require over 1.3 million workers by 2030, nearly triple the current workforce.

These statistics highlight heat pumps' growing importance and potential in the global transition towards sustainable heating.

COP and SEER Ratings

The efficiency of heat pumps is typically measured using two key metrics: the coefficient of performance (COP) and the seasonal energy efficiency ratio (SEER). Heat pumps have a coefficient of performance (COP) of around four, meaning their energy output is four times greater than the electrical energy used to run them. On the other hand, the majority of heat pumps on the market have SEER ratings ranging from 14 to 25 and HSPF ratings between 8 to 11.

Heat pumps can offer significant energy savings and reduce carbon emissions compared to traditional heating and cooling systems. For instance, the efficiency of a heat pump vs a combi boiler is up to 4 times higher. However, their efficiency can vary depending on various factors, including the specific model, operating conditions, and local climate.

Real-world data from the UK-based Electrification of Heat Demonstration Project showed that heat pumps can operate efficiently even in cold weather conditions. The project monitored the performance of 742 air-source heat pumps installed in various types of homes over nearly two years. The results showed a median COP of 2.44 on cold days, indicating that heat pumps continue operating efficiently even in cold weather conditions.

High-efficiency heat pumps generally have SEER ratings of 17 and above, with some of the highest-efficiency air-source heat pumps rated at up to 22 SEER. It's worth noting that upgrading from an older unit with a SEER rating of 8 to a unit with a SEER rating of 15.3 could save you roughly 50% of your energy bill.

However, the ideal SEER rating for your home can depend on various factors, including your local climate conditions and individual preferences.

Global Heat Pump Efficiency: SEER2 and HSPF2 Ratings

Heat pumps have become an energy-efficient alternative to conventional heating technologies. Two key metrics are used to gauge their efficiency: the Seasonal Energy Efficiency Ratio (SEER2) and the Heating Seasonal Performance Factor (HSPF2).

A heat pump's energy output is usually several times greater than the electrical energy used to run it. For example, the coefficient of performance (COP) for a typical household heat pump is around four, meaning the energy output is four times greater than the electrical energy used to run it. This makes current models 3‐5 times more energy efficient than gas boilers.

Heat pumps can also reduce fossil fuel use for heating by 40 per cent or more. They are two to three times more efficient than most current fossil-fuel heating systems, meaning they use much less energy overall. The energy produced by a heat pump can be up to four times more efficient, with 73 per cent less carbon emissions than even the most efficient boilers.

The main difference between the SEER2/HSPF2 and SEER/HSPF ratings is the testing conditions for each rating system. The new testing conditions will produce different data values and warrant a new rating system.

Table 1: Average SEER2 and HSPF2 Ratings for Heat Pumps

| Year | Average SEER2 Rating | Average HSPF2 Rating |

|---|---|---|

| 2018 | 14.5 | 8.2 |

| 2019 | 15.0 | 8.5 |

| 2020 | 15.5 | 8.8 |

| 2021 | 16.0 | 9.0 |

| 2022 | 16.5 | 9.3 |

The table shows a steady rise in both SEER2 and HSPF2 ratings, indicating improved energy efficiency in heat pumps over the years.

As a result, SEER2 ratings for cooling equipment will be a bit lower (approx. 5%) than SEER ratings in most cases, and similarly, for heat pumps, HSPF2 ratings will also be lower (approx. 15%) than HSPF ratings.

Energy Efficiency Compared to Conventional Heating Technologies

Technologies. For instance, a high-efficiency gas boiler might have an efficiency rating of around 90%. In contrast, a heat pump with an average HSPF2 rating of 9.3 (as of 2022) can deliver more than 200% energy efficiency. This is because heat pumps move heat rather than generate it.

| Heating Technology | Energy Efficiency (%) |

|---|---|

| High-efficiency gas boiler | 90 |

| Heat Pump (HSPF2 9.3, 2022) | >200 |

The table above shows that heat energy output is usually several times greater than what is required to power the heat pump, generally in electricity. For example, the coefficient of performance (COP) for a typical household heat pump is around four, i.e., the energy output is four times greater than the electrical energy used to run it.

| Category | Details |

|---|---|

| Heat Pump Efficiency | |

| SEER2 Rating | Measures energy efficiency during cooling months |

| HSPF2 Rating | Measures energy efficiency during heating months |

| Coefficient of Performance (COP) | Energy output is four times greater than the electrical energy used to run it. |

| Heat Pump Sales and Growth | |

| Global Sales Growth in 2022 | 11% |

| Global Sales Growth in 2021 | 13% |

| Sales Growth in the United States in 2021 | 15% |

| Heat Pump Usage and Potential | |

| Global Heat Pump Stock by 2030 | Estimated to reach about 600 million |

| Global Heating Needs Met by Heat Pumps by 2030 | Estimated to cover at least 20% |

| Heat Pump Types | |

| Air-source Heat Pumps | The most common type transfers heat between your house and the outside air |

| Ground- and Water-source Heat Pumps | Most efficient models, but also the most expensive |

| Heat Pump Costs and Barriers | |

| Upfront Costs | Higher than other heating options |

| Cost Barriers | Financial incentives such as grants, tax credits, and low-interest loans are needed. |

| Non-cost Barriers | Manufacturing constraints, potential shortages of qualified installers. |

Global Heat Pump Market

The global heat pump market is expected to grow significantly in the coming years. Its size was estimated at £66.51 billion in 2022 and is expected to grow at a compounded annual growth rate (CAGR) of 9.3% from 2023 to 2030. The market size is expected to be £72.34 billion in 2023 and reach £136.08 billion by 2030.

The global heat pump market was dominated by the air source technology segment, which accounted for over 81% of the market share in 2022. The heat pump segment with up to 10 kW capacity accounted for a market share of 14.7%. In addition, new sales in the Nordic and Baltic countries also have the highest share of air-to-air units, accounting for around 50% to 80% of installations.

Air-to-water heat pumps are the technology of choice in Germany and Poland. Hybrid systems, which combine heat pumps with gas boilers, are popular in Italy, where they accounted for more than 40% of sales in the air-to-water segment in 2022.

| Year | Global Market Size (in £) | Growth Rate (%) | Notable Events |

|---|---|---|---|

| 2021 | £84.5 billion | 15% | Sales led by the European Union with a rise of around 35% |

| 2022 | £106.4 billion | 11% | Sales growth continued with a second year of double-digit growth |

| 2023 | £117.3 billion | 10.3% | Expected growth despite economic disruptions due to the Russia-Ukraine war |

| 2027 | £147.1 billion | 5.8% | Expected growth over the next few years |

This dominance is expected to continue throughout the forecast period, driven by rising initiatives to curb carbon emissions and increasing awareness regarding the ill effects of greenhouse gases on the environment.

Regarding regional market share, Asia Pacific dominated the heat pump market, accounting for 53.1% in 2022. This dominance is attributed to the availability of sizeable skilled labour at low cost and the rising trend of shifting production bases to emerging economies, mainly China and India.

Moreover, energy-saving solutions are gaining prominence in China, Japan, Indonesia, and India. North America, led by the US and Canada, also accounted for a significant share of the global heat pump market in 2022.

The global heat pump market is expected to grow due to increasing demand for energy-efficient solutions and policy support for heat pumps. The UK, in particular, plans to install 600,000 heat pumps annually by 2028. The global market size is expected to reach £147.1 billion by 2027, growing at a CAGR of 5.8%.

Trends Influencing the Rise of Heat Pump Adoption

As we navigate the 21st century, the world is making a concerted effort to shift towards more sustainable, energy-efficient, and environmentally friendly solutions.

The Increasing Demand for Energy-Efficiency

The first and most significant trend is the increasing demand for energy-efficient systems. According to the International Energy Agency (IEA), heat pump sales will grow by more than 10% in 2024 alone. This surge in sales can be attributed to the rising awareness of energy conservation and the need to reduce carbon emissions.

Heat pumps can be up to three times more energy efficient than traditional heating systems, as they transfer heat rather than generate it. This means that three units of heat can be produced for every unit of electricity used. This efficiency is a major attraction for homeowners and businesses looking to reduce energy costs.

Government Policies and Incentives

Government policies and incentives are another significant trend influencing the rise of heat pump adoption. Many governments worldwide implement strict regulations to combat climate change and encourage greener technologies. For instance, the UK government aims to have 600,000 heat pumps installed annually by 2028.

In addition, incentives like tax credits and rebates are offered to individuals and businesses installing heat pump systems. This reduces the required initial investment and makes heat pumps financially viable.

In addition, governments worldwide, especially in China, Japan, the US, South Korea, and Europe, are implementing stringent new building regulations and providing subsidies on the purchase of heat pumps to reduce their carbon footprint and increase the use of renewable sources of energy for heating and cooling purposes.

Technological Advancements

Technological advancements have significantly contributed to increased heat pump adoption. Improved heat pump technology, such as Variable Refrigerant Flow (VRF) and multi-split systems, has made these systems more efficient and versatile.

Similarly, the development of low-temperature heat pumps has expanded the potential applications of these systems, making them suitable for colder climates. According to the US Department of Energy, modern heat pumps can provide heating even when outdoor temperatures are as low as -15 degrees Celsius.

The Impact of COVID-19

The COVID-19 pandemic has also indirectly influenced the rise in heat pump adoption. With more people working and studying from home, there has been an increased demand for efficient heating and cooling systems.

The pandemic has also heightened awareness about the importance of clean and healthy indoor air, a feature that heat pumps can provide through superior air filtration systems.

Heat Pumps in Residential Settings

Heat pumps are increasingly being adopted in homes across the globe due to their energy efficiency and cost-saving benefits. As of 2020, over 17 million housing units had heat pumps installed. In the UK, 16% of households have a heat pump as their primary heating equipment, with adoption levels identical across all income levels.

This trend is also observed in other countries, indicating that adopting heat pumps is not limited to a specific income bracket. For instance, China continues to be the largest market for new sales, while North America has the most significant number of homes with heat pumps today.

Heat pumps have been reported to provide high user satisfaction and comfort. A survey conducted by Nesta found that 80% of their customers were either satisfied or very satisfied with the performance of their heat pumps. Furthermore, households in Great Britain reported being happy with their heat pump system, with lower energy bills and higher comfort levels than their previous heating system.

The average cost of installing an air-source heat pump in the UK ranges from £10,000 to £14,000, while ground-source heat pumps can cost between £14,500 and £45,000. These figures include the cost of the heat pump unit, installation, and any necessary upgrades to the existing heating system or insulation.

The government's Boiler Upgrade Scheme (BUS) provides grants of up to £7,500 to help offset the upfront costs, reducing the actual cost to homeowners to £7,000 - £37,500 for air source heat pumps and £7,000 - £37,500 for ground source heat pumps.

The installation costs of heat pumps can differ notably from one region to another due to variations in labour costs, the complexity of installation required, and the type of heat pump system installed.

Below is a detailed table that outlines the average installation costs across different UK regions, factoring in the BUS grant:

| Region | Air Source Heat Pump Cost (£) | Ground Source Heat Pump Cost (£) |

|---|---|---|

| South East England | £10,000 - £14,000 | £15,000 - £35,000 |

| South West England | £9,000 - £13,000 | £14,000 - £34,000 |

| London | £11,000 - £15,000 | £16,000 - £36,000 |

| Midlands | £9,500 - £13,500 | £14,500 - £34,500 |

| North West England | £8,500 - £12,500 | £13,500 - £33,500 |

| North East England | £8,000 - £12,000 | £13,000 - £33,000 |

| Scotland | £9,000 - £13,000 | £14,000 - £34,000 |

| Wales | £9,000 - £13,000 | £14,000 - £34,000 |

In addition, the economic impact of heat pumps has led to significant energy bill savings. On average, homeowners can save up to £757 per year by switching to a heat pump, and they save clients about 20-40% on their annual heating and cooling bills.

The table below provides an estimate of the average annual savings a homeowner can make depending on their current heating system:

| Current heating equipment | Average yearly savings (£) |

|---|---|

| Natural gas furnace | £79 |

| Electric furnace | £616 |

| Propane furnace | £646 |

| Baseboard heaters | £973 |

| Fuel oil boiler | £702 |

| Fuel oil furnace | £716 |

Furthermore, heat pumps have an environmental impact as an energy-efficient alternative to traditional heating systems. They can reach efficiencies of 300% to 400%, meaning they output three to four times as much energy in the form of heat as they consume in electricity. This efficiency can reduce up to 7.6 tons of annual carbon emissions per household.

Significant countries and the percentage of households in each country that have a heat pump installed.

| Country | Number of Heat Pumps Installed | Percentage of Households with Heat Pumps |

|---|---|---|

| Norway | 1.5 million | 60% |

| Sweden | 1.38 million | 43% |

| Finland | 1.14 million | 41% |

| Estonia | 180,000 | 34% |

| United States | 17.2 million | 14% |

| China | 58.4 million | 33% |

| United Kingdom | 55,000 | 0.19% |

| Japan | 8.5 million | 81% |

In Europe, 20 million heat pumps have been installed, amounting to 25%. The countries with the highest heat pump adoption rates are Norway, Sweden, Finland, and Estonia. In the United States, the share of households primarily using heat pumps for space heating jumped from 8 per cent to 14 per cent from 2005 to 2020. China has the highest number of heat pumps installed, with 58.4 million as of 2020.

Conversely, the UK and other European nations lag, with recent efforts to catch up. The European Heat Pump Association reported a 5% decline in sales across 14 European countries in 2023, starkly contrasting the previous decade's growth. On the other hand, the United States also shows a significant adoption rate, with around 40% of new single-family homes opting for heat pump heating.

It's important to note that the adoption and usage of heat pumps vary significantly by region due to climate, energy policies, and financial incentives. For instance, heat pumps are more common in colder climates like Norway, Sweden, Finland, and Estonia, despite the misconception that they don't work well in such conditions.

In contrast, heat pumps are mainly absent from heating markets in Central Asia and some parts of Eastern Europe due to high upfront costs and the prevalence of district heating networks.

In the US, heat pumps have become more popular than gas furnaces for heating buildings, with most residential units being air-to-air models in ducted air systems. Meanwhile, in China, the demand for heat pumps is driven by the country's status as the largest producer and exporter of this technology.

In Europe, the adoption of heat pumps varies by country. For example, France, Italy, Spain, and Portugal have seen the highest rate of heat pump installations, with annual installations per household more than doubling over a decade. However, these countries primarily use reversible air-to-air heat pumps for cooling rather than heating.

Adopting heat pumps in residential settings is a growing trend positively impacting the industry and society.

The future of heat pumps: Predictions for 2024 and beyond

The future looks promising, with significant market growth potential for reducing greenhouse gas emissions. By 2050, heat pumps could eliminate the need for a separate air conditioner for the 2.6 billion people living in regions requiring heating and cooling.

This advantage will increase further as electricity systems decarbonise. By 2030, heat pumps have the potential to reduce global carbon dioxide emissions by at least 500 million tonnes.

Many environmentalists believe heat pumps are revolutionary, and governments must promote them immediately. In the UK, the government has allocated £192 million of the appropriated Defense Production Act funds to support the manufacturing and deployment of electric heat pumps.

This technology could provide high-efficiency heating in freezing temperatures without producing greenhouse gas emissions, saving families at least £385 on their utility bills.

The following predictions and trends for heat pumps in 2024 and beyond are based on technological advancements and improvements in energy efficiency.

Technological Advancements

- Cold Climate Heat Pumps: The US Department of Energy's Cold Climate Heat Pump Challenge has led Lennox International to develop a next-generation heat pump prototype. This prototype delivers 100% heating at 5°F and 70-80% heating at -10°F, with deployment and commercialisation aimed for 2024.

- Inverter-driven variable speed compressors: These compressors increase speed to improve heating capacity as outdoor temperatures drop, making heat pumps more efficient in colder climates.

Energy Efficiency Improvements

- Annual efficiency improvements: On average, the efficiency of heat pumps increases by about 2% annually.

- SEER2 ratings: Starting in 2024, new residential central air-conditioning and air-source heat pump systems in the US will be required to meet new minimum energy efficiency standards based on the SEER2 protocol.

Impact on Industry and Society

- Reduction in greenhouse gas emissions: Installing heat pumps instead of traditional boilers and furnaces could cut global CO2 emissions by at least 500 million tonnes in 2030.

- Job creation: Global employment in heat pump supply is expected to nearly triple to over 1.3 million workers by 2030, with growth in installation, maintenance, and manufacturing.

- Energy savings: By replacing an older heating and cooling unit with a heat pump, the typical homeowner can save more on energy and heating bills in a year.

These highlight the growing importance of heat pumps in today's environment and the impact of these trends on the industry and society.

As we look toward the future, it's clear that heat pumps, with their impressive SEER2 and HSPF2 ratings, will play a pivotal role in our efforts to reduce carbon emissions and create a sustainable environment.

With technological advancements, we can expect further improvements in their efficiency, adaptability to a range of climates, and compatibility with renewable energy sources.

In this light, the future of heat pumps is not just bright; it's essential.

Inemesit is a seasoned content writer with 9 years of experience in B2B and B2C. Her expertise in sustainability and green technologies guides readers towards eco-friendly choices, significantly contributing to the field of renewable energy and environmental sustainability.

We strive to connect our customers with the right product and supplier. Would you like to be part of GreenMatch?