Answer these simple questions and we will find you the BEST prices

Which type of solar quotes do you need?

It only takes 30 seconds

100% free with no obligation

Get up to 4 quotes from our selected suppliers by filling in only 1 form

Save money by comparing quotes and choosing the most competitive offer

Our service is 100% free and with no obligation

- GreenMatch

- Green Energy

- Green Energy Grants

- Renewable Heat Incentive

Renewable Heat Incentive

What Is the Renewable Heat Incentive (RHI)?

The Renewable Heat Incentive (RHI) is a scheme formed by the UK Government, among other heat pump grants, to incentivize private households, communities, and businesses to adopt renewable energy technologies for heating, such as air source heat pumps in the UK, by providing financial assistance.

On 1 April 2021, changes to the RHI scheme have come into force. Applicants who commissioned their eligible heating system on or after 1 March 2019 can now apply for accreditation to the RHI scheme.

Applications that have been unable to comply with the 12-month submission rule can now re-apply until the scheme ends on 31 March 2022.

Read more on ofgem site.

The RHI was first established in April 2014, and on the 22nd of May 2018, the latest regulations came into effect. RHI was set up to minimise the effects of climate change, as well as being the main driver towards the UK’s goal for 2020, which is to have 12% of heating coming from renewable energy sources.

There are two types of RHI schemes: domestic and non‑domestic Renewable Heat Incentive.

Only the following types of renewable heating systems are eligible for the domestic RHI scheme:

How Does the Renewable Heat Incentive Work?

The domestic RHI works as a financial support program for households with renewable energy heating systems. With the help of the RHI, households can save a significant amount of money in the long run, if they have eligible heating systems like heat pumps installed in their home.

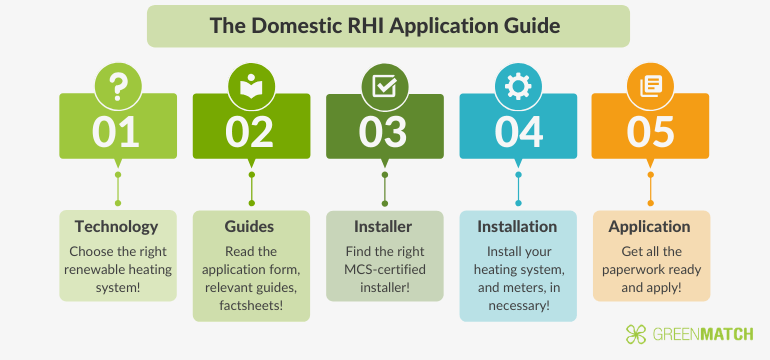

In order to be approved for the domestic RHI, it is very important to be aware of all the steps in the application process. There are various requirements at each step that applicants must be familiar with, relating to both the renewable energy technology installation and the home itself.

Quality time spent on investigating the right renewable heating solution and installer increases the chance of your RHI application being approved.

How Are Domestic RHI Payments Calculated?

The domestic RHI payments are calculated taking into consideration three major factors:

The rate of RHI payments that you receive can change year by year. Since the Renewable Heat Incentive came into force, the scheme used a ‘degression’ system created to manage the budget for the domestic RHI.

However, on 1 December 2019, the Department for Business, Energy and Industrial Strategy (BEIS) announced that there will be no degression on 1 January 2020.

The table below illustrates the current and future Ofgem RHI tariffs for each of the eligible renewable heating systems.

| Applications submitted | Biomass boilers and stoves (p/kWh) | Air source heat pumps (p/kWh) | Ground source heat pumps (p/kWh) | Solar thermal (p/kWh) |

|---|---|---|---|---|

| 01/10/2019 - 31/12/2019 | 6.88p | 10.71p | 20.89p | 21.09p |

| 01/01/2020 - 31/03/2020 | 6.88p | 10.71p | 20.89p | 21.09p |

| 01/04/2020 - 30/06/2020 | 6.97p | 10.85p | 21.17p | 21.37p |

| If any new tariff changes are to be made due to degression, the announcement by BEIS would be made by 1 June 2020. | ||||

* These tariffs were adjusted in line with Consumer Price Index (CPI)

Fill in the form in just 1 minute

Here is an example of how domestic RHI Payments can be calculated:

In case you do not want to make calculations yourself, use the RHI calculator to find out what payments you could receive from installing a renewable heating technology.

Ofgem introduced new customer protection regulations on 15 December 2020 that will support customers that are struggling to pay for their energy bills.

The regulations will protect those that are vulnerable and temporarily unable to pay their energy bills in the form of more appropriate credit management policies and sustainable repayment plans.

How Do I Install an RHI Heating System?

After thorough research of all the RHI scheme requirements, it is wise to consider all the pros and cons of heat pumps and other eligible renewable energy heating systems. It is important to pick the best renewable energy heating technology for your household that will not only serve as an energy source but also lead to significant savings on your energy bills. Therefore, it is advisable to consult with professionals before embarking on your home improvements project.

Together with the installation of your chosen renewable heating system, you might also have to install metering. There are two types of metering: metering for performance and metering for payment. Which type is required depends on your choice of heating system.

‘Metering for performance’ is an eligibility obligation for all new heat pumps. ‘Metering for payments’ is an eligibility requirement for heat pumps, biomass stoves, and boilers.

As a contrary, if you have assessed all the pros and cons of solar energy you opted to go for solar thermal system, you do not have to install metering. The reason being that for heating domestic water, solar thermal is not obligated to be metered.

Lastly, you should spend some time choosing the right renewable energy heating technology installer. Alongside that, make sure that your heating system installer has a Microgeneration Certification Scheme (MCS) certificate.

RHI - How Do I Apply?

In order to apply for the domestic RHI, you have to live in England, Scotland or Wales. Thereafter, to apply for the domestic RHI, you have to own a home, be either private or social landlord, or build a new property yourself, meeting all the necessary requirements.

When it comes to the required documents you will need a Microgeneration Certification Scheme (MCS) installation certificate number, which you should receive after the MCS certified installer completes the installation of your renewable heating system.

Thereafter, the Green Deal Assessment for your building will have to be carried out. This assessment is made up of two documents:

Additionally, you have to be ready to give your bank details and the amount you have paid for the installation of your renewable heating system. If you have received payments from public funds before, you should put it on notice, including the amount you got and when you were paid.

- Microgeneration Certification Scheme (MCS) certificate number

- Energy Performance Certificate (EPC) number

- Occupancy Assessment document

- Personal information and bank details

Ongoing Renewable Heat Incentive Obligations

From the day you apply to the domestic RHI you automatically consent to all the ongoing obligations that go with the scheme. One of your responsibilities is complying with the ongoing obligations related to your household and the specific renewable energy heating system that you have installed.

Year after year, you have to fill out an annual declaration. By completing the declaration, you ensure that you comply with all the scheme rules so that the right amount of money is paid for the heat that you generate.

These are some of the annual declarations you will have to submit:

On top of that, Ofgem carry out audit checks to make sure that every domestic RHI participant follows the scheme rules. Anyone who has applied to the domestic RHI can be chosen for the audit check at any time. Audit checks for renewable heating technologies are selected based on multiple reasons, as well as random sampling.

Frequently Asked Questions About the Domestic RHI

After you have been approved for the domestic RHI you will receive quarterly payments (every three months). RHI payments will be transferred directly to your bank account by BACS transfer. Payments will be transferred only to the UK bank accounts that accept pound sterling deposits.

The domestic RHI payments are granted to owners of domestic properties who have installed one of the eligible heating systems and have applied for the financial incentive. Exact amounts of these payments are determined the type of renewable energy heating system installed, latest tariffs, and metering.

Once you have been approved for the domestic RHI, you will receive payments every quarter, for seven years. Be aware that you have to continue to comply with the domestic RHI scheme rules in order to receive payments. Otherwise, you run the risk of not receiving any payments.

The exact amount of money you could save with RHI depend on your heating system, renewable heat that the system generates, and the current tariffs. Overall, you could save between £200 and £4,000 every year just from RHI payments.

In general, the tax you pay is not affected by the type of RHI scheme (domestic or non-domestic). It is affected by the way you use renewable heat. For instance, if you are using renewable heat only for personal domestic use, the payments are not chargeable to income tax. On the other hand, if you are a business or a trader, RHI payments are a business receipt, meaning that normal income and corporate rules and deductions apply to the receipt.

Heat pump installation costs are mainly dependent on the price of the heat pump itself, which varies based on the system’s heating capacity, as well as the cost of the installation type. For example, ground source heat pump installation costs, including the heat pump price and installation costs can be around £11,000 – £20,000.

Fill in the form in just 1 minute

Valli has been writing well researched articles about renewable energy, sustainability and green technologies for GreenMatch since 2017. Her work has been published in various media such as Entrepreneur, Business Insider, Canadian Geographic, uSwitch, and eCycle.

We strive to connect our customers with the right product and supplier. Would you like to be part of GreenMatch?