- GreenMatch

- Glass or Aluminum: Which Is Better For The Environment?

Glass or Aluminium: Which is the Greenest Choice?

The choice between glass and aluminium in terms of environmental sustainability is complex. It depends on several factors, including the material's life cycle, energy consumption in production and recycling, transportation costs, and the recycling rate.

The environmental impact of glass and aluminium as packaging materials is multifaceted, each with advantages and disadvantages.

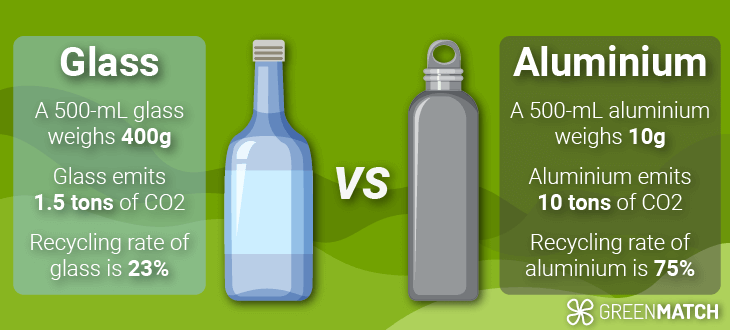

Aluminium has several advantages over glass. It is lightweight and durable, reducing energy consumption and transportation waste. Aluminium can also be recycled indefinitely without losing quality, making it more sustainable.

On the other hand, glass bottles are made from relatively harmless raw materials and are entirely recyclable. Using recycled glass to produce new glass bottles reduces the manufacturer's carbon footprint, which requires only 30% less energy than virgin glass.

From an energy efficiency standpoint, glass production requires more energy inputs than aluminium. However, the energy efficiency of glass improves when it is recycled. This means that glass can be back on the shelves within 30 days of recycling.

| Material | Energy for Production (MJ/kg) | Energy for Recycling (MJ/kg) | Greenhouse Gas Emissions (kg CO2e/kg) |

| Glass | 13.0 | 11.3 | 0.33 |

| Aluminium | 194.7 | 47.5 | 1.88 |

Energy Consumption in Glass and Aluminium Production

Let's look at the energy consumption in producing these materials, focusing on their production processes.

Energy Consumption in Aluminium Production

Aluminium production is energy-intensive. On average, about 17,000 kWh of electricity are required to produce 1 tonne of aluminium. For instance, Hydro's pilot plant in Karmøy, Norway, has managed to decrease energy consumption to 12.3 kWh per kilogram of aluminium, which is well below the world average of 14.1 kWh.

The primary aluminium smelting process consumed 1,807,960.3193036 Gigawatt hours (GWh) globally 2022. This process involves the use of electrolysis, which is a significant consumer of electrical energy.

Energy Consumption in Glass Production

The glass industry is also highly energy-intensive. Gas is the predominant energy source used for flat glass manufacturing, accounting for approximately 75% of the energy consumption, while electricity accounts for around 25%. This means that the bulk of energy consumed in the glass manufacturing industry comes from natural gas combustion used to heat furnaces to melt raw materials.

The glass industry consumes approximately 500–700 million GJ each year. The transformation of raw materials into glass is energy-intensive, requiring high temperatures that result in carbon dioxide emissions.

Comparison of Energy Consumption: Glass vs Aluminium

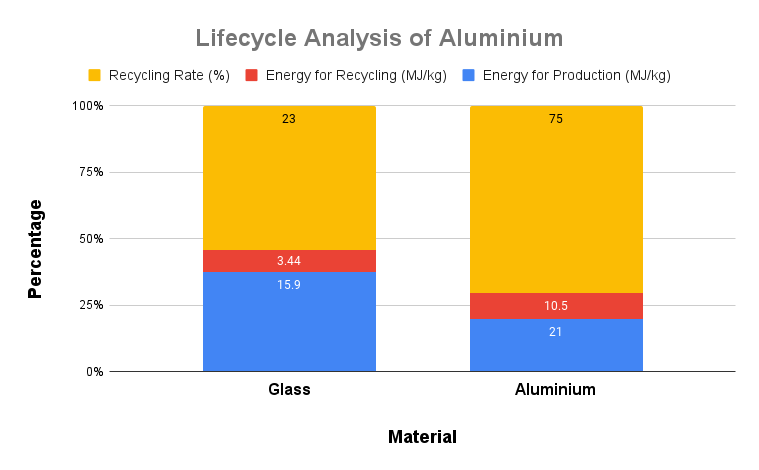

When comparing the energy consumption of glass and aluminium, it's essential to consider the entire lifecycle of the materials, from production to disposal.

Aluminium requires nearly twice as much energy as glass to manufacture, with an estimated 1.09 kilowatt-hours of energy needed to manufacture a glass bottle compared to nearly twice as much for an aluminium can.

Producing tons of virgin aluminium from bauxite ore requires nearly twice as much energy as manufacturing a glass bottle. However, recycling an aluminium can uses 90% less energy than recycling a glass bottle.

On the other hand, transforming raw materials into glass is energy-intensive, requiring high temperatures that result in carbon dioxide emissions.

| Material | Energy Consumption in Production (kWh per tonne) | Energy Consumption in Recycling (kWh per tonne) |

| Aluminium | 17,000 | 1,700 (90% less than production) |

| Glass | 1,090 (estimated) | 10,810 (90% less energy-efficient than aluminium recycling) |

Furthermore, the lightweight nature of aluminium reduces energy consumption during transportation compared to glass. For instance, a one-litre glass bottle can weigh up to 800g, whereas a similar-sized aluminium can weigh significantly less.

Carbon Footprint from Glass and Aluminium

The production of these materials is a significant source of greenhouse gas (GHG) emissions, contributing to climate change.

Studies have shown that single-use glass bottles have a higher carbon footprint than aluminium cans, even when the glass is 100% recycled.

This process results in significant CO2 emissions, with Europe producing 22 million tonnes and a global output of 95 million tonnes of CO2 annually.

Efforts to reduce these emissions include the development of technologies such as those from the LIFE Eco-HeatOx and LIFE CleanOx projects. This has shown a reduction in CO2 emissions, leading to a 6 to 9% energy saving and a 23% by preheating pure oxygen and natural gas.

However, the environmental impact of glass can be mitigated by recycling. Switching from clear to green glass can cut packaging-related CO2 emissions by 20%.

Moreover, using recycled aluminium significantly reduces emissions, with new scrap producing only 0.5 tonnes of CO2e per tonne of recycled aluminium.

To illustrate the emissions associated with glass and aluminium production, the following table presents the most current data available:

| Material | CO2 Emissions (Europe) | CO2 Emissions (Global Production) | CO2 Emissions (Recycling) | Embodied Carbon per m³ |

| Glass | 22 million tonnes | 95 million tonnes (Global) | 20% reduction with green glass | 12090kg |

| Aluminium | N/A | 16 tonnes CO2e/tonne | 0.5 tonnes CO2e/tonne (new scrap) | 18009kg |

Both glass and aluminium have significant environmental impacts in terms of GHG emissions. For example, aluminium produced using hydropower in regions like North America and Europe has a lower carbon footprint than coal in China and India.

However, it's important to note that the environmental impact of single-use glass bottles surpasses that of aluminium cans, even when the glass bottles are made from 100% recycled materials.

Comparative Environmental Impact of Glass and Aluminium

When comparing glass and aluminium, several factors include their physical properties, environmental impact, recyclability, and cost. The choice between the two depends on the application's specific requirements, including cost, weight, environmental impact, and recyclability.

| Property | Aluminium | Glass |

| Elastic Modulus (GPa) | 68 | 67 to 80 |

| Tensile Strength (MPa) | 68 to 190 | 280 |

| Density (g/cm3) | 2.7 | 2.2 to 2.6 |

| Weight (pounds per cubic foot) | 168.48 | 156 |

| Recycled Content (%) | 73 | Varies |

| Value in Recycling Bin (£/ton) | 991 | -23 |

| Cost | Less expensive | More expensive |

Recyclability of Glass and Aluminium

Recyclability is a crucial aspect of sustainability, focusing on reducing waste and conserving resources.

When comparing the recyclability of glass and aluminium, several factors come into play, including the energy required for recycling and the quality of the recycled material.

In terms of value in the recycling bin, aluminium cans are more valuable than glass, with a value of £991/ton compared to a negative value of £23/ton for glass. Aluminium cans are typically less expensive than glass bottles.

Energy Required for Recycling Glass and Aluminium

Aluminium is one of the most recyclable materials, with high recycling rates. Recycling aluminium consumes only 5% of the energy needed for primary production.

On the other hand, recycled glass requires 30% less energy than virgin glass. However, the process of producing aluminium from bauxite ore requires much less energy than the process of producing glass.

To illustrate the recyclability and energy efficiency of glass and aluminium, the following table uses the most current data available:

| Material | Energy Required for Recycling (vs Virgin Material) | Energy Savings | Quality After Recycling | Recycling Rate (Europe) | Energy Required for Production (kWh) | Global Recycling Rate |

| Glass | 50% less energy | 30% less energy (Moderate) | Can lose quality | 80% | 1.09 (for glass bottle) | Less than 35% |

| Aluminum | 95% less energy | 95% less energy | No loss in quality | 73% | 2.07 (from bauxite) | 76% efficiency rate |

Quality of Recycled Material

Aluminium can be recycled indefinitely without losing its quality. This makes it more environmentally friendly than glass, which can lose quality during recycling. Glass, however, can also be recycled indefinitely without any loss in quality, reducing the need for continuous production.

Economic and Environmental Benefits Glass and Aluminium

Recycling glass and aluminium reduces production expenses and makes products more affordable due to lower material costs. For aluminium, the economic benefits are also notable, as the production of recycled aluminium far exceeds that of primary aluminium, indicating a robust recycling system.

Recycling Rates and Regional Variations

The recycling rates of glass and aluminium vary significantly across different regions.

In North America, approximately 45% of metal materials are recycled. The UK aims to recycle 65% of municipal waste by 2035 but currently stands at about 45%.

For instance, glass has a recycling rate of a lower percentage in North America and 80 per cent in Europe.

On a global scale, the recycling rate for container glass is estimated at 32%, while the rate for flat glass is only 11%. China leads in recycled aluminium production, recycling some 12,771 metric kilotons of metal in 2021.

On the other hand, aluminium is one of the most recyclable materials, with high recycling rates. For example, in 2020, beer and soft drink cans were the most recycled category in the United States at 50.4%. The United States has a glass recycling rate of approximately 33%, compared to 90% in countries like Switzerland and Germany.

While both glass and aluminium are highly recyclable materials that contribute to sustainability, aluminium stands out due to its superior energy efficiency in the recycling process and higher recycling rates.

Lifecycle Analysis of Glass and Aluminum

The lifecycle analysis (LCA) is crucial for understanding the environmental impacts of materials like glass and aluminium. The choice between the two materials should be based on a thorough lifecycle analysis considering regional recycling capabilities and the product's intended use.

Lifecycle Analysis

| Material | Production Energy (kWh/kg) | Recyclability | Environmental Impact During Use | End-of-Life |

| Glass | High (due to melting point) | High (indefinitely recyclable) | Low (inert material) | Recyclable (energy savings) |

| Aluminum | High (for primary production) | High (indefinitely recyclable) | Low (durable and lightweight) | Recyclable (significant energy savings) |

Lifecycle Analysis of Glass

Production begins with extracting natural raw materials like sand, soda ash, and limestone for glass. The lifecycle analysis of glass includes all stages, from raw material extraction to manufacturing, use, and end-of-life management, which often involves recycling.

The glass recycling rate is significant, with an average post-consumer recycle input rate of 23 per cent. This recycling effort saves a substantial amount of CO2 equivalent from being released into the atmosphere compared to strictly virgin materials.

This growth is driven by energy-efficient products, increasing demand for lightweight materials, the automotive industry, recyclable packaging and the rising use of green construction.

Lifecycle Analysis of Aluminium

Aluminium production starts with bauxite extraction, which contains 15-25% aluminium. The lifecycle analysis of aluminium includes all stages, from bauxite mining to alumina refining, primary aluminium production, use, and end-of-life management, which often involves recycling.

The production of aluminium involves high energy consumption and CO2 emissions. However, recycling aluminium can save about 90% of the energy used in extracting aluminium from bauxite ore.

This makes aluminium a highly sustainable material when considering its entire lifecycle.

Comparison of Glass and Aluminum Lifecycles

When comparing the lifecycles of glass and aluminium, several factors come into play:

Future Prospects of Glass and Aluminum

The materials industry constantly evolves, with sustainability at the forefront of innovation. These materials will likely be crucial in choosing our products and packaging materials.

The global glass market was valued at £90 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.5% from 2024 to 2030. The global aluminium market was valued at £120 billion in 2023 and is expected to grow at a CAGR of 5.5% from 2024 to 2030.

Current Trends and Predictions

Consumers are increasingly paying attention to the sustainability of the products they purchase, including the packaging in which products are sold. This has led to a rise in the use of glass and aluminium, as both materials can be recycled indefinitely.

Predictions for the future suggest that both materials will continue to be used extensively, with improvements in recycling processes and energy efficiency. The beverage industry, for example, is likely to continue leveraging both materials, with aluminium cans favoured for their lower transportation footprint and higher recycled content.

Choosing Between Glass vs Aluminium:

The choice often depends on the context. For instance, aluminium cans are a more sustainable choice for beer packaging due to their lower carbon footprint in production and transportation. They also preserve the flavour and quality of beer better than glass bottles.

However, if recycled cans are not an option, glass should be your pick. Glass bottles are more durable and can be reused multiple times, reducing waste production and water consumption.

| Factors | Glass | Aluminium |

| Cost | Generally cheaper | More expensive |

| Strength | Brittle but strong in compression | Strong in tension and compression |

| Weight | Heavier | Lighter |

| Aesthetics | Transparent allows natural light | Metallic, modern look |

| Environmental Impact | Highly recyclable, energy-intensive to produce | Highly recyclable, energy-intensive to produce but less so when recycled |

Glass vs Aluminum: The "Greenest" Choice

When considering the "greenest" choice, looking at the entire product lifecycle is essential. Aluminum has a higher recycling rate and is more valuable in the recycling system, which can drive better recycling practices.

Both glass and aluminium have their environmental pros and cons.

Aluminium cans are lighter and easier to transport than glass bottles, reducing their greenhouse gas emissions. Glass bottles, on the other hand, have a weight and transportation footprint that are their downfall. This makes it not to be the most eco-friendly choice.

| Material | Cost (£/ton) | Recyclability Rate (%) | Carbon Footprint (kg CO2e/ton) |

| Glass | -23 | 31.8 | 1.1 |

| Aluminium | 991 | 92.6 | 0.6 |

In conclusion, both glass and aluminium have their merits and drawbacks regarding sustainability. The specific context, including the availability of recycled materials, local recycling infrastructure, and transportation logistics, should inform the choice between them.

In the future, the glass industry is expected to witness significant innovation.

As the industry continues to innovate, we may see advancements that further improve the sustainability of both materials.

Inemesit is a seasoned content writer with 9 years of experience in B2B and B2C. Her expertise in sustainability and green technologies guides readers towards eco-friendly choices, significantly contributing to the field of renewable energy and environmental sustainability.

We strive to connect our customers with the right product and supplier. Would you like to be part of GreenMatch?