Answer these simple questions and we will find you the BEST prices

Which type of solar quotes do you need?

It only takes 30 seconds

100% free with no obligation

Get up to 3 quotes by filling in only 1 quick form

Slash your energy bills by installing an energy efficient boiler

We’ve helped over 500,000 homeowners reduce their carbon footprint

- GreenMatch

- Boilers

- Boilers on Finance

Boilers on Finance in the UK: How To Pay Monthly

If your boiler repair bills keep climbing up, this means your heating friend might be breathing its last. And sometimes boiler replacement isn't something you can afford on the fly. In case this is your situation, then getting boilers on finance is the way to go.

This article will tell you everything you need to know about boiler finance in the UK: how it works, its pros and cons as well as ways to get the best boiler finance deals. However, to choose from all the boilers out there for your situation, you'll need an installer you can trust.

However, searching for boiler quotes or experienced engineers can drag on for weeks if done alone. It’s unlikely that you’re looking forward to spending your valuable free time googling and manually vetting installers.

Thankfully, GreenMatch can help you avoid all the stress. By completing our 30-second form you get up to 3 comparison quotes from engineers near you. The quotes are free and come with no obligation to accept any of them. Click below to get started!

- Quotes from local engineers

- Payment by finance available

- Save up to £975

It only takes 30 seconds

- How does boiler finance work?

- Can you get a pay monthly boiler on 0% finance?

- How do you get the best boiler finance deals?

- How much does a new boiler on finance cost

- Pay monthly boiler and credit check: How does it work?

- Can you get a boiler on finance with a bad credit score?

- Pros and cons of boilers on finance

- Is getting a boiler on finance a good idea?

- FAQ

How does boiler finance work?

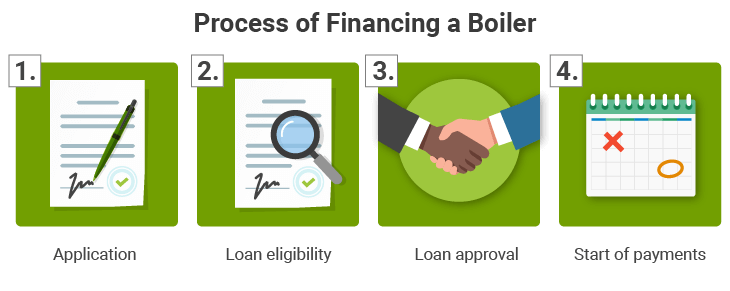

Boiler finance, or the boilers on 0 finance scheme works by allowing you to borrow money from a lender to cover the cost of a new boiler. You then repay the loan over a period of time, typically in monthly instalments.

To enrol for a new boiler 0% finance program, you must complete an application process similar to any other credit agreement. Your personal information, including your credit score, will be assessed to verify your ability to meet the monthly repayment obligations.

Upon approval of your application, the lender will cover the initial expenses associated with installing your new boiler. Subsequently, you will reimburse the lender over a predetermined period. While some boiler finance plans may request an upfront deposit for the boiler, others may not require it. The interest you'll repay can also differ from one provider to another.

Before committing to any contract, it's essential to conduct thorough research and compare all available options. These agreements typically extend over a considerable time frame, making it imperative to make an informed decision rather than hastily entering into such a commitment.

Can you get a pay monthly boiler on 0% finance?

Yes, many boiler companies and lenders offer 0% boiler finance, typically over a period of 12 to 48 months. This means that you can spread the cost of your new boiler over a number of months without having to pay any interest. This is a perfect solution for those who can't afford to pay the upfront price of a boiler with one lump sum payment.

To qualify for 0% finance on a boiler, you will typically need to have a good credit history. You may also need to make a deposit on the boiler.

It's important to note that a bad credit history won't let you get on the pay monthly boiler schemes. However, buying a boiler on finance is possible in this situation as well. More on that later.

How do you get the best boiler finance deals?

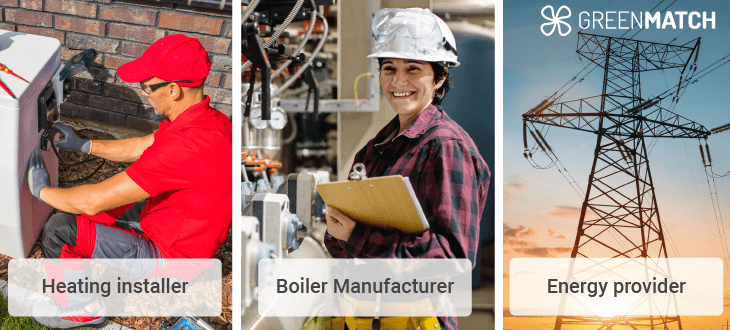

You can get your boiler financed through the following contractors:

However, to get the best boiler finance deals, it is important to compare the different options available and choose the one that is best for your needs. When discussing a new boiler on finance with a bank or a heating company, you should consider the following factors:

If you want to buy a boiler on finance in the UK, there are multiple options across each country. Whether you're looking for boilers on finance in Scotland or Wales, you need to meet standard eligibility criteria but of course, they may vary from company to company. So make sure you compare several options.

| Country | Companies | General eligibility criteria |

|---|---|---|

| England | Heatable, iHeat, BOXT, Boiler Central, E.ON, British Gas | A UK permanent resident (at least 3 years) aged between 18–85 with a valid, in-date passport or a valid, in-date UK driving licence, a bill within the last 3 months with your name on it, and stable income. |

| Scotland | The Glasgow Boiler Company, New Boilers Glasgow, BRB Heating, McRoberts Heating, Heatable, iHeat | |

| Wales | Oil 4 Wales, BOXT, Boiler Central, iHeat, E.ON, BT Morgan Heating Engineers | |

| Northern Ireland | Heating Solutions NI, Belfast Gas, Hynes Plumbing & Heating, Refresh NI |

Keep in mind that you can also apply for boiler grants which can save you money on your initial investment or maybe even cover the whole price of your boiler.

Not sure which deal fits your situation best? A certified heating engineer can help you choose the best boiler for your needs. However, finding a professional you can trust is a real challenge for a busy homeowner. Sacrificing time out with friends to search, call, and vet experts is unlikely what you’re up for at the weekend.

Luckily, GreenMatch can help you out. Completing our form takes less than a minute and brings you up to 3 free quotes from heating experts. You can compare those quotes to find the best deal. Our offer is completely free and non-binding. Just click the button below to get started!

- Quotes from local engineers

- Payment by finance available

- Save up to £975

It only takes 30 seconds

How much does a new boiler on finance cost

The cost of a new boiler on finance will vary depending on a number of factors, including the type of boiler, the size of your property, and the location of your property.

On average, the monthly pay for boilers on finance in the UK is between £75 and £150. This will depend on the finance option you choose and the repayment term.

For example, if you choose a £2,000 boiler with a 12-month interest-free loan, your monthly repayments will be around £167. If you choose a £3,000 boiler with a 24-month low-interest loan, your monthly repayments will be around £125.

There are two different finance options available for new boilers, including:

The table below shows the monthly payments* you would make over both a 3-year and a 10-year plan based on a total boiler installation price of £2,246 (interest rate per annum = 12.2%, representative APR = 12.9%).

| Pay Monthly Boilers No Deposit | Pay Monthly Boilers With Deposit | |||

|---|---|---|---|---|

| Repayment Period | 3 years / 36 months | 10 years / 120 months | 3 years / 36 months | 10 years / 120 months |

| Deposit | £0 | £0 | £1,045.25 | £1,070.50 |

| Total Loan Amount | £2,246 | £2,246 | £1,200.75 | £1,175.50 |

| Total Charge for Credit | £447.16 | £1,651.60 | £239.25 | £864.50 |

| Total Amount Repayable | £2,693.16 | £3,897.60 | £2,485.25 | £3,110.50 |

| Monthly Cost | £74.81 | £32.48 | £40.00 | £17.00 |

If you are unsure which boiler finance deal suits your situation, it is a good idea to seek help from a financial advisor. They can help you to compare the different options available and choose the one that is best for your needs.

Pay monthly boiler and credit check: How does it work?

When you apply for a ‘pay monthly’ boiler, the lender will typically carry out a credit check. This is to assess your creditworthiness and determine the likelihood of you repaying the loan.

The lender will look at a number of factors, including:

If the lender is satisfied with your creditworthiness, they will approve your loan. You will then be able to spread the cost of your new boiler over a number of months, typically 12 to 48 months.

Can you get a boiler on finance with a bad credit score?

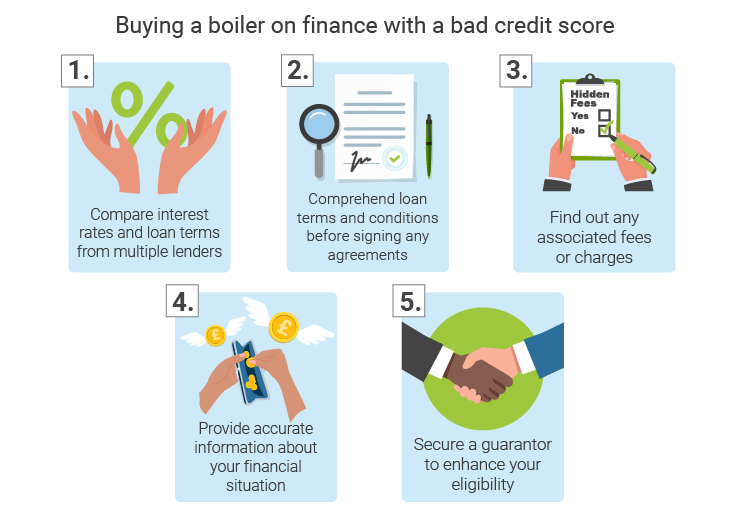

Yes, securing boiler financing with a less-than-ideal credit score is indeed feasible, although, you should remember that not all lenders will offer pay monthly boiler schemes to people with bad credit.

However, there are some lenders who specialise in offering boiler finance to people with bad credit or no credit history. As mentioned earlier, your choices may be more limited, and you might encounter higher interest rates.

Also, certain lenders may set a larger upfront deposit or a shorter repayment period. Additionally, you may be asked to enlist a guarantor i.e., an individual who agrees to assume the loan if you are unable to fulfil the repayments.

For those with a bad credit history seeking boiler financing, it's essential to compare the various available options and select a lender willing to collaborate with you. Furthermore, ensure that you have the financial capacity to meet the monthly repayment commitments before pursuing financing.

It's also worth mentioning that with some companies, it's possible to get the "pay monthly with no credit checks" deal. With some "boiler rental" options you'll need to pay a small deposit without a credit check or interest. The ownership of the boiler transfers to you when the final monthly instalment of the rental agreement is received.

Other services offer boiler subscriptions, peer-to-peer lending, or renting a boiler option without a traditional credit check.

While getting a boiler on finance with no credit checks is certainly possible, the list of contractors is very limited and you might face harsh payment conditions.

Pros and cons of boilers on finance

Opting for boilers on finance can present an attractive solution for homeowners seeking to avoid the initial expense of installing a new boiler. However, before investing in a new boiler on finance deal, it's important to weigh the pros and cons.

Advantages of pay monthly boilers

If this list wasn't convincing enough, you could consult with a professional installer further. However, searching for a trusted engineer on your own can stretch for days and easily become a stressful and daunting task you’d want to delegate.

Thankfully, GreenMatch can help you avoid the hassle. Filling out our form takes only 30 seconds and brings up to 3 free quotes from vetted heating experts near you. Compare the quotes without committing to any orders. Click the button below to get started.

- Quotes from local engineers

- Payment by finance available

- Save up to £975

It only takes 30 seconds

Disadvantages of pay monthly boilers

Is getting a boiler on finance a good idea?

If you're in a situation where that new system or combi boiler is a must, right when you can't afford it, deciding to buy a boiler on finance is a perfect solution. Yet, it's important to weigh all the pros and cons before making your decision.

While boilers on 0 finance mostly come with no upfront costs and flexible repayment periods, the interest charges can be quite high and bind you to long-term payments.

Moreover, if your credit history isn't that bright, finding a contractor can be challenging. On the flip side, boiler installation on finance allows you to get the heating solution when your home needs it without having to save money for a new boiler.

Each homeowner's financial and housing situation is unique and requires a tailored approach. An experienced boiler installer can help you with that. However, searching for qualified engineers by yourself involves a lot of valuable hours spent googling and making calls.

Great if you have that much time to spare, but what if you don't? Do you want to spend your whole weekend searching for installers instead of having quality family time?

With GreenMatch, you can streamline this process and get better and more reliable deals on boilers.

Get access to up to 3 free quotes from this network just by filling in a short form on the type of boiler you're looking for. We then take it from there while you wait to receive boiler quotes. After receiving quotes, you can then choose the best combi boiler deal for you (with no obligation!).

- Quotes from local engineers

- Payment by finance available

- Save up to £975

It only takes 30 seconds

FAQ

Yes, it’s worth getting a boiler on finance if your financial situation doesn’t allow you to cover a large upfront payment for a new boiler.

Yes, it’s possible to get combi boilers on finance, just like oil boilers on finance or any other type of boiler. You just need to apply for a loan and go through the rest of the application procedure.

Yes, it’s possible to secure a new boiler on finance with bad credit. However, in this case, fewer options might be available to you.

Yes, you can buy boilers on finance in Scotland just like elsewhere across the UK. Multiple companies there provide pay monthly boiler schemes as well as 0% interest for a specific timeframe, and fixed interest rates for up to 10 years.

We strive to connect our customers with the right product and supplier. Would you like to be part of GreenMatch?

- How does boiler finance work?

- Can you get a pay monthly boiler on 0% finance?

- How do you get the best boiler finance deals?

- How much does a new boiler on finance cost

- Pay monthly boiler and credit check: How does it work?

- Can you get a boiler on finance with a bad credit score?

- Pros and cons of boilers on finance

- Is getting a boiler on finance a good idea?

- FAQ