- GreenMatch

- Blog

- How Does a Green Mortgage Work?

How Does a Green Mortgage Work? Full 2025 Guide

- Green mortgages provide financial incentives such as reduced interest rates or cashback for buying energy-efficient homes or remodelling properties in order to make them greener.

- Homes that have a higher Energy Performance Certificate (EPC) rating of A or B can sell up to 10.9% more. This makes green mortgages a smart economic and sustainable investment.

- Lenders such as Barclays, Natwest, and Virgin Money offer green mortgage possibilities, encouraging homeowners to lower their utility costs and carbon footprint.

Nowadays, traditional homes frequently lack the energy-efficient features that are needed to lower carbon emissions and utility costs. But this problem goes beyond just increasing bills, it significantly affects our environmental footprint.

For this, green mortgages have been designed in order to help and encourage homeowners that can’t afford energy-efficient homes. But, what is it exactly?

With the UK's homes being accountable for about 26% of the nation’s total carbon emissions, green mortgages are the solution to reducing residential energy waste. These specially designed loans make it more affordable for buyers to purchase energy-efficient homes or for homeowners to make sustainable changes to their current home.

The real question is, do green mortgages help fight climate change and save homeowners money? In this piece, we’ll discover how green mortgages work and all the necessary information you need to know.

- What is a green mortgage

- Difference between green mortgages and traditional mortgages

- Advantages of green mortgages

- Disadvantages of green mortgages

- How does a green mortgage work

- How 'green' are green mortgages really?

- Costs of green mortgages

- Eligibility criteria for a green mortgage

- How do I apply for a green mortgage?

- FAQ

What is a green mortgage?

A green mortgage is an eco-friendly type of mortgage designed to purchase or renovate your home. It promotes a sustainable lifestyle by providing favourable conditions to homeowners or buyers of energy-efficient properties and to those who improve their homes with green technologies, such as installing the most efficient solar panels in the UK, better insulation, heat pumps, and more. By granting lower interest rates or cashback inducement, green mortgages help homeowners diminish their environmental impact and their long-term energy costs.

For instance, Barclays offers beneficial interest rates for green mortgages in new-build homes with an A or B rating in the EPC. As of February 7 2025, Barclays provides a 2-year term green mortgage at 4.48% for 60% loan-to-value (LTV). These rates are created to be more affordable than traditional mortgages, encouraging borrowers to decide on greener homes.

The initiative “green mortgage” was created from united efforts to increase energy efficiency in properties across Europe. The BUILD UPON project played a remarkable role in promoting green mortgages and their future by contributing to the objectives of renovating existing homes throughout Europe. A harmonised approach resulted from this initiative and its close sharing of ideas with the European Mortgage Federation (EMF).

Since it was introduced, these loans have quickly grown in the UK with the purpose of encouraging eco-friendly housing. With 61 products available as of 2024, the green mortgage sector has significantly expanded since 2019.

The two types of green mortgages

The two types of green mortgages are the following:

- For purchasing or renewing energy-efficient properties: These mortgages are accessible for homeowners who obtained the Energy Performance Certificate (EPC) ratings of A or B. Lenders provide them with small discounts on common mortgage costs or cashback inducements for these highly eco-friendly homes. The small amount varies depending on the lender, for instance, HSBC UK provides a £500 cashback for properties that have rated a A or B in the EPC.

- For properties that are upgrading to greener homes: By implementing upgrades to your home, for instance installing solar panels, lenders will arrange incentives such as lower rates on supplementary borrowing, cashback, or lessen mortgage rates. The amount reduced changes based on the lender. For example, Coventry Building Society offers a lower interest rate on their ‘Green Additional Borrowing’ outcome when more than 50% of the loan is applied to energy-efficient homes.

Difference between green mortgages and traditional mortgages

| Feature | Green Mortgage | Traditional Mortgage |

|---|---|---|

| Interest Rates | Higher rates, no energy-efficiency inducement. E.g. NatWest: 4.50% interests rates | Ordinary rates, no energy-efficiency inducement.E.g. TSB: 4.39% interest rates |

| Eligibility Criteria | Essential for homes to meet energy standards (EPC- rating of A or B) | No clear sustainable criteria |

| Incentives | Provides refunds, cashback, or affordable borrowing for energy-efficient improvements | Usually, no additional incentives |

| Repayment Terms | Might provide more flexible reimbursement options to foster sustainable investments | Standard repayment terms |

| Energy Efficiency Focus | Encourages buying or reconstructing of energy-efficient properties | No focus on energy efficiency |

| Cost Savings | Decreased utility costs and capability for increased resale value due to eco-friendly features | Usual utility costs and resale value |

Main differences:

- Purpose: Green mortgages incite the buying or upgrades of energy-efficient properties. Meanwhile, traditional mortgages have nothing to do with sustainable goals.

- Financial benefits: Green mortgages tend to produce higher interest rates. However, they offer cashback incentives and savings on utility bills caused by lower energy consumption.

- Qualification: Green mortgages require compliance to certain ecological requirements, including having a high EPC qualification. On the other hand, this is not necessary for traditional mortgages.

- Sustainability impact: Green mortgages support carbon reduction outcomes and environmental consciousness while coordinating with broader climate objectives.

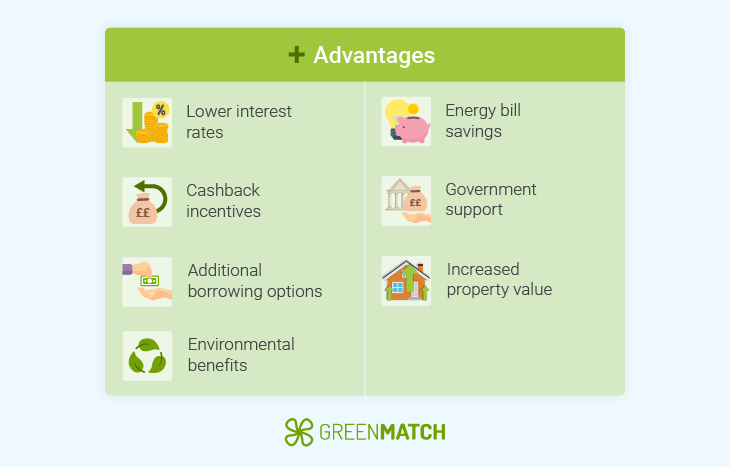

Advantages of green mortgages

- Lower interest rates: Multiple UK lenders provide lower interest rates for eco-friendly, sustainable homes.

- Cashback incentives: Some lenders (e.g. Virgin Money) offer cashback for those who improved their homes and made them greener.

- Additional borrowing options: Several lenders offer discounted rates for extra money borrowed to finance sustainable improvements.

- Energy bill savings: Energy-efficient properties lower utility costs, assisting homeowners and helping them save money in the long run.

- Government support: The UK government is financing green home initiatives, which include a £5 million fund for green mortgage expansion.

- Increased property value: Eco-friendly homes in the UK sell up to 10.9% more than homes rated a D or lower in the EPC.

- Environmental benefits: Green mortgages help reduce carbon emissions and position with the UK's net-zero objectives by encouraging energy-efficient properties.

Disadvantages of green mortgages

- Limited availability: Despite the growth in the UK market, green mortgages are currently less common than traditional mortgages.

- Strict eligibility criteria: To qualify for a green mortgage, homes must meet the exact EPC rating of A or B, occasionally C, which then excludes several older properties.

- Higher upfront costs: Choosing to remodel your home to meet the green mortgage standards can require upfront expenses. To give an example, the price of new windows varies from £450 to £1,200, as it depends on the number of windows and the material used.

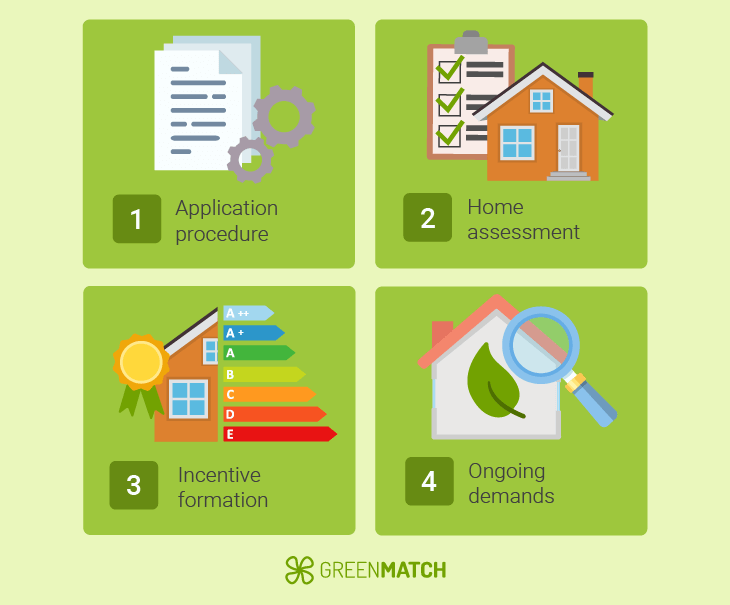

How does a green mortgage work?

A green mortgage works similarly to a traditional mortgage, in which borrowers make monthly reimbursements and pay interest on the amount they borrowed. The main difference that distinguishes both has to do with the compensation offered for owning or buying energy-efficient homes. This compensation covers low interest rates or cashback inducements, which are aligned to the environmental area of the house, usually evaluated through an Energy Performance Certificate.

- Application procedure: Closely resembles traditional mortgages, containing credit checks and cost-effective evaluations.

- Home assessment: The energy efficiency of the home is normally evaluated through the EPC rating.

- Incentive formation: The borrower will be benefited if the home meets the necessary energy-efficient requirements.

- Ongoing demands: For homeowners to maintain their advantages, certain lenders can demand that you keep your energy-efficient rating high.

How 'green' are green mortgages really?

The only true aspect that is ‘green’ about green mortgages is the home you’re moving into or the home upgrades you’re making. Consequently, while the lender is trying to increase the possibility of you living in an environmentally friendly home, the mortgage itself has nothing green.

With a traditional mortgage, you still take a big amount of money and repay it in monthly installments, with the interest being provided to your lender so it can be invested. The lender might still be financing eco-friendly harmful businesses, such as fossil fuels, even if you have a green mortgage.

If you consider and show interest in applying for a green mortgage but feel uneasy about the lender’s green criteria, more information can be found on sites like Bank Green and Banking on Climate Chaos.

Costs of green mortgages

The costs of green mortgages resolutely differ from the costs of traditional mortgages as their principal focus is on sustainability and the benefits that come with it. Although green mortgages may come with increased costs due to the demands of energy-efficient properties, these costs are reduced by long-term savings and the increased property value.

Below is a comparison table between green mortgages and traditional mortgages.

| Costs/Savings feature | Green Mortgage | Traditional Mortgage |

|---|---|---|

| Initial mortgage costs | Higher because of energy-efficient property demands | Lower initial costs |

| Interest rates | Lower. As of February 2025, the general interest rate varies from 4.13% as the lowest to 5.46% as the highest | Higher. In 2025 mortgage rates are expected to moderate by about 6.6% |

| Monthly payments | Lower as the interest rates are reduced | Higher as a consequence of standard rates |

| Energy bill savings | Potential savings depending on your home, the amount changes by property | No inherent savings |

| Potential tax incentives | Available on specific cases. For instance, rebates for energy-efficient improvements | Generally not available |

| Property value increase | Homes with an EPC rating of A or B can capture a superior price of 10.9% in comparison to similar homes with a D rating | Usual market appreciation |

Homes that have a rating of A or B in the Energy Performance Certificate (EPC) can sell for a price up to 10.9% higher compared to homes that are rated D or lower. For homeowners, this makes green mortgages an appealing option as they prioritize sustainability. For buyers, it reduces operating expenses when purchasing properties. In addition, as of February 2025, lower interest rates have lessened monthly payments, as they offer monetary reassurance in comparison to traditional mortgages.

Energy bill savings are another advantage, even though the amount received depends on your property and its regulation changes. For example, the installation of heat pumps can crucially reduce electricity and heating bills in the long-term. Moreover, specific green mortgages present tax incentives for sustainable upgrades in your home, building to the overall savings.

Although traditional mortgages may have minor upfront costs and not many restrictions, green mortgages range with an increasing market demand for eco-friendly homes. Since energy-efficient properties become more attractive, homeowners not only save money on costs but also take advantage of increased resale values and a powerful market interest.

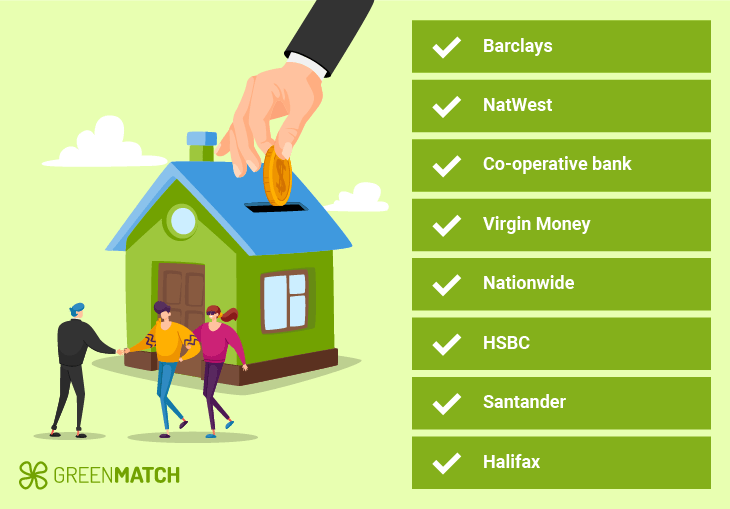

Green mortgages lenders

There are several available green mortgages from different lenders. These are:

- Barclays: Provides a favourable interest rate if you purchase a new-build property with an energy efficiency rating of 81 or higher, or an EPC rated A or B. Furthermore, it offers a ‘greener home reward’ of up to £2,000 for current Barclays mortgage holders that convey green home upgrades. There’s no need to take money or take out a loan to be eligible for this reward.

- NatWest: If you purchase a home with a qualified EPC rating of A or B you can be sufficiently qualified for a green mortgage. These provide a lower rate of interest on a 2 year or 5 year mortgage. Additionally, it’s also possible to get cashback.

- Co-operative bank: Provides an advantageous interest rate if purchasing a home rated A or B in the EPC and where the loan-to-value is between 80% and 95%.

- Virgin Money: Offers a beneficial interest rate for buyers looking for a new-build home with a high EPC rating of A or B. It also supplies £250 cashback to borrowers who might need additional money to perform green home upgrades.

- Nationwide: In the case of Nationwide, if you buy a house with them, the lender will compensate you with £500 cashback as long as the home has scored above a 92 on its EPC. Nonetheless, it also offers £250 cashback if the home has scored between 86 to 91. This is on top of any supplementary cashback offers.

- HSBC: Provides buyers with a £500 cashback to those who are buying or remodeling a residential property with an A or B rating in the EPC.

- Santander: Offers favourable interest rates for homeowners who are intending on remodeling their home where the home has an EPC rating of A or B. This advantage is only accessible through brokers and your loan-to-value must be between 60% and 85%. Moreover, Santander borrowers can earn up to £500 cashback by improving their home and making it greener.

- Halifax: Halifax provides cashback if you purchase or remodel a main domiciliary home with a score of A or B in the EPC. It also offers £2,000 in cashback to those who upgrade their home and make it energy-efficient.

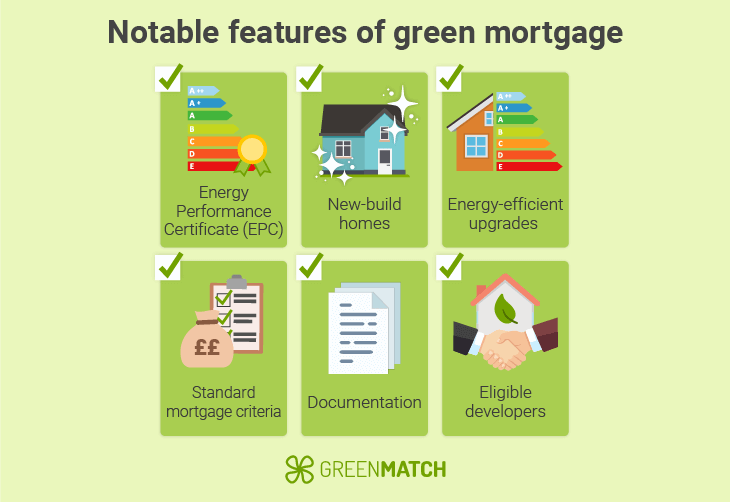

Eligibility criteria for a green mortgage

To qualify for a green mortgage in the UK, it’s essential to meet the requested qualifications, focusing specifically on the energy efficiency of the property and the candidate's financial solidity.

Energy Performance Certificate (EPC)

Most lenders demand homes to have an EPC rating of A or B, making sure you meet the required energy efficiency. This rating evaluates the energy performance of the property or building and is essential to determine eligibility.

New-build homes

Particular green mortgages supply explicitly to new-build properties from approved developers. These homes tend to have a Predicted Energy Assessment (PEA) or an EPC rating of A or B. This way, they make sure there is energy efficiency from the start.

Energy-efficient upgrades

Candidates can meet the requirements by committing to fundamental energy-efficient improvements, such as installing double-glazed windows, solar panels, and so on. This will permit homeowners to upgrade existing homes in order to meet green home requirements.

Standard mortgage criteria

Applicants must meet typical cost-effective checks, including evidence of income, creditworthiness, and employment security. Lenders will rate your monetary situation to be sure you can meet the mortgage payments.

Documentation

A valid EPC, issued within the last 10 years, is essential for existing homes. On the other hand, for new ones, a PEA from the developer may be required until the final EPC is available. By providing proper documentation, you can verify the sustainability of the property.

Eligible developers

Certain lenders, for example NatWest, restrain green mortgages to homes purchased from particular developers. This assures the homes meet the lender’s requirements for sustainability.

How do I apply for a green mortgage?

To apply for a mortgage in the United Kingdom, it’s essential to pay attention to the following steps:

- Earn an Energy Performance Certificate (EPC) for your home: The majority of lenders demand an EPC rating of A or B, occasionally a few might accept C. Moreover, be open to sustainable changes. If your home doesn’t meet the demanded rating, you can always consider making energy-efficient changes in order to qualify.

- Research lenders and their requirements: By researching and learning about the different lenders, as well as comparing their terms and rates, you can then easily decide which one suits you best.

- Collect the necessary documentation: Gather documents such as proof of income, creditworthiness, and employment security.

- AiP Initiation: Once you have chosen your lender, apply for an Agreement in Principle (AiP)

- Green Eligibility Consultation: Meet with a mortgage advisor to go over your application and confirm your eligibility for a green mortgage. Include revising the energy performance certificate or predicted energy assessment from your home with the advisor.

- Eco-focused application: Complete the entire green mortgage application process, which is very much like a traditional mortgage, except this one has an additional focus on your home’s sustainability regulations.

- Sustainable home purchase: If approved, move forward with buying your new home.

FAQ

Yes, generally, a green mortgage can be transferred to another property. This process is known as ‘mortgage porting’, and it authorises borrowers to maintain their current mortgage terms if moving homes. Ask your lender about your mortgage porting options while applying.

Yes, it’s possible to switch to a green mortgage as long as your home meets the sustainability demands (EPC rating of A or B). If you haven’t obtained the EPC, you can perform changes to improve your home’s energy efficiency, that way, you can become eligible.

To convert your existing mortgage to any type of green mortgage, look closely at the following steps:

- Evaluate your home’s energy efficiency and obtain an A or B rating on your Energy Performance Certificate.

- Upgrade your home’s energy efficiency. You can do this by installing solar panels, double-glazed doors, and so on.

- Research different lenders and compare their terms and prices.

- Get together the demanded documentation, including proof of income and the revised EPC.

- Once decided, apply for a green mortgage.

With a green mortgage, you are able to save money, but the precise amount may vary based on the lender, the terms of the loan, and how energy-efficient your home is. In specific cases, lenders provide cashback incentives or lower interest rates for environmentally friendly homes. Furthermore, the main advantage of green mortgages occurs from long-term energy bill cutbacks.

Yes, in the UK there are government incentives for green mortgages. At present, the government has launched funding programs, for instance, the £5 million Green Home Finance Innovation Fund, focused on encouraging the development of green mortgage products that reward homeowners for upgrading their homes and making them energy-efficient.

Carmen is a writer at GreenMatch who has a strong interest in renewable energy and finds purpose in educating others on sustainable practices that will help create a more environmentally friendly future. Her attention to detail and dedication to accuracy ensure that every piece is reliable and helpful.

We strive to connect our customers with the right product and supplier. Would you like to be part of GreenMatch?

- What is a green mortgage

- Difference between green mortgages and traditional mortgages

- Advantages of green mortgages

- Disadvantages of green mortgages

- How does a green mortgage work

- How 'green' are green mortgages really?

- Costs of green mortgages

- Eligibility criteria for a green mortgage

- How do I apply for a green mortgage?

- FAQ