Answer these simple questions and we will find you the BEST prices

Which type of solar quotes do you need?

It only takes 30 seconds

100% free with no obligation

You need to fill in only 1 form to get free quotes

We call you to confirm your enquiry

Receive quotes from local installers

- GreenMatch

- Blog

- Global Heat Pump Statistics

Global Heat Pump Statistics

1. About 190 million heat pump units were in operation in buildings worldwide in 2021. In the same year, record high growth in heat pump sales was registered in particular in Europe, China and the United States.

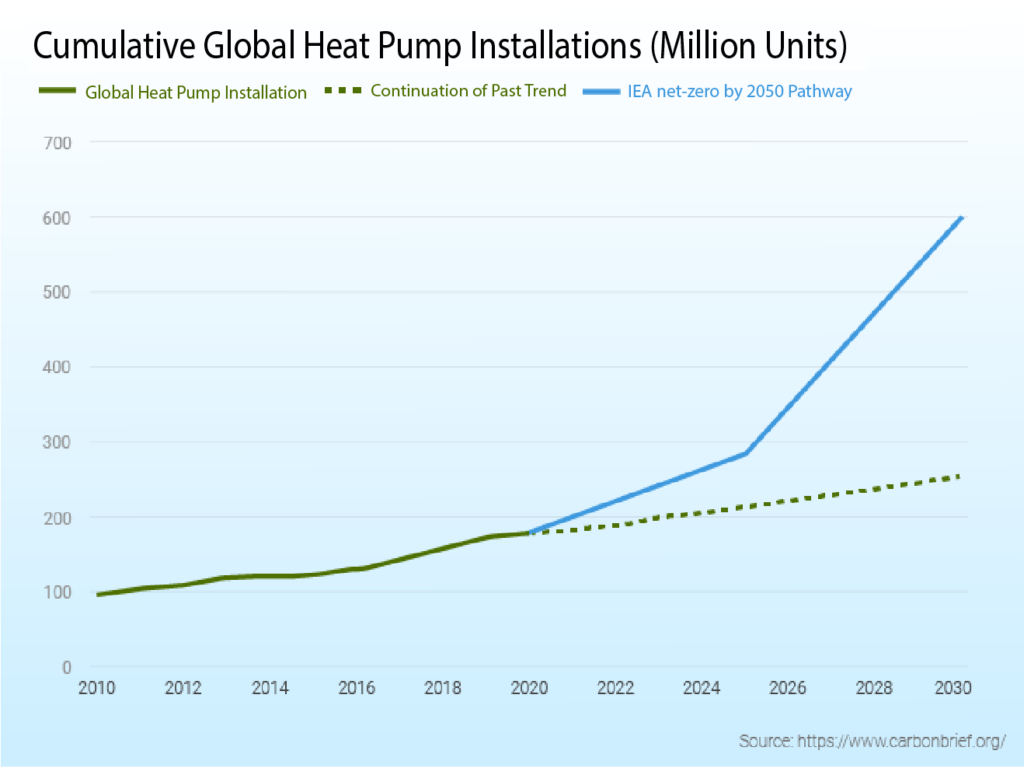

2. Heat pumps still meet only around 10% of the global heating need in buildings though, below the deployment level required to get on track with the Net Zero Emissions by 2050 Scenario. In this scenario, the global heat pump stock reaches about 600 million by 2030, covering at least 20% of global heating needs.

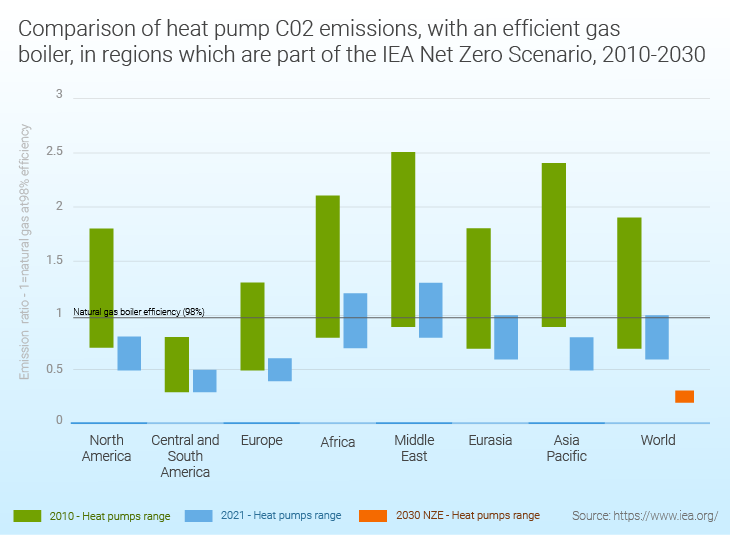

3. The energy produced from a heat pump is up to 4x more efficient, with 73% less carbon emissions than even the most efficient boilers.

4. Heat pumps last about twice as long as a boiler (up to 20 years) and cost less in maintenance.

5. Further policy support and technical innovation are needed, in particular, to reduce upfront purchase and installation costs; remove market barriers to complex renovations; improve energy performance and durability; and exploit the potential of heat pumps as an enabler of power system integration and flexibility (IEA).

6. In some markets such as Japan and the European Union, and to some extent South Korea, heat supplied from heat pumps is credited as renewable, making them eligible to support under certain renewable energy policy schemes. In 2022 China also recognised heat pumps as a renewable energy technology at the national level (IEA).

7. In 2021 heat pump sales increased by more than 13% globally. In the European Union, of which the largest markets are France, Italy and Germany, sales grew by around 35% year-on-year, exceeding 2.2 million units.

The next most dynamic markets were the United States (up 15%), Japan (up 13%) and China (up 13% for air-source heat pumps). Air-source heat pumps account for the majority of sales globally, with a market share of more than 60% in 2021.

8. Ground-source (or geothermal) heat pumps can deliver heating and cooling with higher efficiency than air-source heat pumps, yet due to their higher cost and the specific skills required for installation, they represent only a small portion of global sales – and only about 2.5% of heat pumps installed in the European Union.

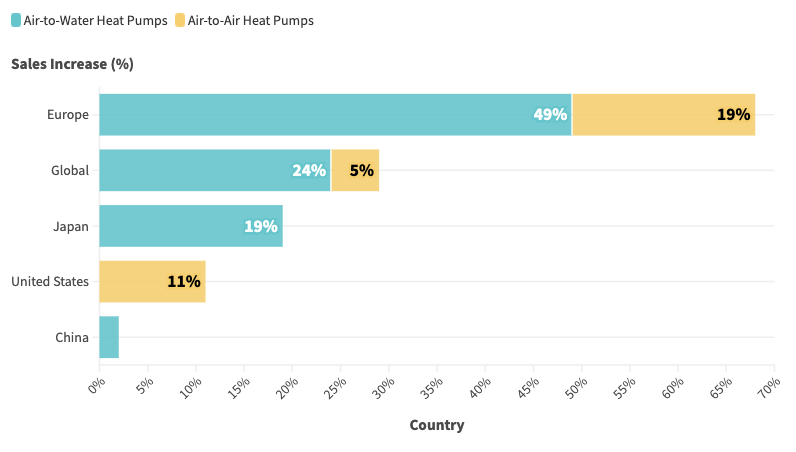

9. Global heat pump sales grew by 11% in 2022, marking a second year of growth for the technology. Europe had a record year of sales, with air-to-water models selling almost 50% more.

Graph Data Source: IEA

10. The lifetime cost of heat pumps is now cheaper than oil and gas for heating in several countries. Yet, heat pumps represented less than 10% of global heating equipment sales in 2021, while fossil fuel equipment still accounted for 45%.

11. Approximately 77 policies or government incentives exist globally, directly to encourage heat pump use (a full list can be found here).

12. Financial incentives for heat pumps are already available in over 30 countries, which together cover more than 70% of heating demand today. (Energy Post)

13. The IEA estimates heat pumps globally have the potential to reduce global carbon dioxide (CO2) emissions by at least 500 million tonnes in 2030 – equal to the annual CO2 emissions of all cars in Europe today.

14. Annual sales of heat pumps in the EU could rise to 7 million by 2030 – up from 2 million in 2021 – if governments succeed in hitting their emissions reduction and energy security goals.

15. Heating buildings accounts for one-third of EU gas demand today. Heat pumps could reduce that demand by nearly 7 billion cubic meters (bcm) in 2025 – roughly equal to the natural gas supplied via the Trans Adriatic Pipeline in 2021. This annual gas saving would grow to at least 21 bcm by 2030 if EU climate targets are met (IEA).

16. Energy savings from a heat pump can be significant for low-income households, ranging between 2% and 6% of household income.

17. Leading manufacturers are seeing promising signs that today’s momentum and policy support could put the industry on a trajectory that triples sales by 2030 – and they have accordingly announced plans to invest more than $4 billion in expanding heat pump production and related efforts, mostly in Europe. (IEA)

18. Opportunities exist for heat pumps to provide low-temperature heat in industrial sectors, especially in the paper, food and chemicals industries. In Europe alone, 15 gigawatts of heat pumps could be installed across 3,000 facilities in these three sectors, which have been hit hard by recent rises in natural gas prices (IEA).

19. Global heat pump supply and installation could require over 1.3 million workers by 2030, nearly triple the current amount, raising the potential for skilled labour shortages, especially for installers.

20. The additional global upfront investment in heat pumps required to reach announced climate pledges reaches $160 billion annually by 2030.

21. Investment in heat pumps grew by 25% in 2021, driven by exponential growth in the European Union, the United Kingdom and Japan.

22.

Data Source Citation: IEA, Relative CO2 emissions from the operation of air-source heat pumps compared with the most efficient condensing gas boilers by region in the Net Zero Scenario, 2010-2030, IEA, Paris, IEA. Licence: CC BY 4.0

Note: CO2 emissions from heat pumps are indirect emissions from the electricity used, according to regional power generation mixes. The emissions index is defined as the ratio of CO2 emissions from operating a heat pump to CO2 emissions from operating a gas boiler with an efficiency of 98%. The ranges reflect variations in the efficiency of heat pump installations, with average seasonal performance values, assumed to vary from 2.4 to 4.0.

23. Over 1.5 million heat pumps were installed across Europe in 2020 (Energy Saving Trust).

24. Air source heat pumps in the UK typically cost between £7,000 and £13,000. Prices depend on the size of the heat pump, the type of home and individual heating requirements.

25. The average household in England, Scotland or Wales could save up to £1,500* per year by switching to an air-source heat pump (if they are replacing old electric storage heaters).

For those replacing an old, G-rated, gas boiler annual savings could be up to £590*. This is based on installing an air source heat pump in a three-bedroom, semi-detached home.

*Figures are based on fuel prices from October 2022 UK.

26. Switching to a highly efficient heat pump from a coal-burning heat system in the UK, can save the average household 7000kg of C02 from entering the atmosphere each year.

Switching from a new A-rated gas boiler, households can save 1800kg of C02 per year.

*Savings figures do vary depending on the country, size of the home, and the heating system being upgraded.

27. Ground source heat pumps in the UK cost between £24,000 and £49,000 to install. The price will vary depending on whether the system you install is buried underground in horizontal trenches, or dug in via boreholes.

28. Ground source heat pumps could save the average UK household up to £1,600 per year, when replacing old storage heaters. To replace an old gas boiler, savings can be £670 per year.

*Based on fuel prices as of October 2022. England, Scotland and Wales only.

(Energy Saving Trust)

29. Installing a ground source heat pump can reduce the average UK household's C02 emissions by between 1500 - 7000kg per year. (Energy Saving Trust)

30. Greenpeace-commissioned research has shown that installing the 900,000 heat pumps needed to meet UK climate targets would create 138,600 new jobs, and bring a £10bn boost to the UK economy by 2030.

31. The IEA’s global heat pump stock figures in the chart below, show that at current trends only 253m heat pumps would be installed globally by 2030, compared with the 600m units needed by that year in the IEA’s net-zero scenario – a shortfall of 58%.

(Energy in Demand)

Source: Carbonbrief.org ; Energy in Demand Authors’ analysis and IEA.

Note: Global stock of heat pumps through to 2020 (green line) and growth to 2030 under a continuation of past trends (dashed line), versus the number of units installed under the IEA’s net-zero pathway (blue).

32. Globally, just 177m heat pumps had been installed by 2020. Most of these heat pumps were in China (33%), followed by North America (23%) and Europe (12%).

(Energy in Demand)

33. In Europe, the four countries with the largest share of heat pumps are Norway (60% of households), Sweden (43% of households), Finland (41% of households) and Estonia (34% of households). These four countries also face the coldest winters in Europe.

34. Policy and directives which will boost heat pump numbers across the globe:

-

The European Green Deal in the EU, aims to double installations to 4 million per year.

-

In Germany, from 2026 all new heating systems must run on at least 65% renewable energy.

-

Norway, Sweden, Denmark and Finland will ban new oil-based heating systems in all buildings.

-

The Netherlands no longer allows new homes to connect to the gas grid,

- Ireland, Flanders (Belgium) and Austria have announced bans on oil boilers for new buildings.

-

Ireland launched an €8bn scheme that nearly doubles the value of grants for heat pumps, as the country looks to ship 400,000 heat pumps into homes by 2030.

-

The UK aims to phase out gas boilers by 2035. They also announced the Boiler Upgrade Scheme and other funding to support the installation of heat pumps.

- The US is pushing to electrify homes and has banned fossil fuel heating in some areas. There is also a ‘Build Back Better’ plan, which, if it goes ahead, will include a 10-year $3.5bn rebate program for electric homes with up to $4,000 for heat pumps, among other incentives.

Source: Carbon Brief

35. New survey findings show that more than 70% of UK home heating installers want to install heat pumps but aren’t trained to do so. Even if they were, 95% don’t have the Microgeneration Certification Scheme (MCS) accreditation necessary to access the Boiler Upgrade Scheme (BUS) (or the Smart Export Guarantee) on behalf of their customers.

(Renewable Energy Installer)

36. The global heat pump market will grow from $115.74 billion in 2022 to $127.71 billion in 2023 at a compound annual growth rate (CAGR) of 10.3%.

(Reporterlink via Yahoo!Finance)

37. Some of the prominent players operating in the global heat pump market are:

- Carrier

- Daikin Industries, Ltd

- NIBE GroupViessmann Group

- Glen Dimplex

- BDR Thermea Group

- Midea Group

- Hitachi, Ltd.

- Ingersoll Rand Plc.

- STIEBEL ELTRON GmbH & Co. KG

- Vaillant Group

- Robert Bosch GmbH

- The Danfoss Group

Source: Grand View Research

38. Installation of heat pumps in individual buildings is forecast to rise from 1.5 million per month currently to around 5 million by 2030.

39. Heat pumps in combination with energy storage can absorb fluctuations in variable renewable generation, which will enable around 40% of electricity to be produced by solar PV and wind power by 2030.

40. In Sweden, 29% of the heating demand in buildings is covered by heat pumps and the corresponding figure for Finland is 15%. In the United States, about 40% of new single-family homes are heated by heat pumps. (IEA)

41. In order to reach the IEA’s model of ‘Net Zero’ by 2050, 55% of home heating will need to come from heat pumps. With around 1,800 million units being installed by 2050.

42. By the end of 2021, the EHPA counted a total of 16.96 million heat pump units installed across 21 countries covered in their annual report*. 15.33 million of these heat pumps are used for space heating.

*Austria, Belgium, Switzerland, the Czech Republic, Germany, Denmark, Estonia, Spain, Finland, France, Hungary, Ireland, Italy, Lithuania, the Netherlands, Norway, Poland, Portugal, Sweden, Slovakia and the UK.

43. Today's heat pumps can cover a wider temperature range than a decade ago. They are able to operate at -25'C and more often can provide hot water at 65'C in an efficient manner. This enables more deployment in a larger share of buildings than has been possible before. (EHPA)

44. The European Union foresees 40% of all residential and 65% of all commercial buildings to be heated by electricity in 2030. As the energy efficiency first principle is still valid, this means most of these buildings will be heated and cooled by heat pump systems.

Becky is an experienced SEO content writer specialising in sustainability and renewable trends. Her background in broadcast journalism inspires reliable content to help readers live more sustainably every day.

We strive to connect our customers with the right product and supplier. Would you like to be part of GreenMatch?