- GreenMatch

- Blog

- Energy Prices Drive Inflation

Inflation in Europe Brings Forward Clean Energy Transition

Inflation in the Euro area is soaring at rates not seen since the 1980s, hitting 7.4% in April 2022. Energy price surges continue to compound the worst effects of inflation, stressing the urgency for a self-sufficient energy system.

Inflation will continue as economies adjust to the green transition and move towards renewable technologies such as solar panels and the supply-demand dynamics it will bring, resulting in broad price increases across a range of commodities.

The cost of the green transition will bring economic challenges, causing further inflation in the future, according to the Central European Bank. Therefore, the Euro area needs a resilient and contained energy infrastructure less vulnerable to market spikes.

Euro Zone & UK Inflation

Bar chart template from Flourish

If you would like to share this chart, please use the embed code below:

Cost of Living Crisis in the UK

In April 2022, the UK’s annual inflation rate rose by 9%, up 2.5% from March 2022.

According to constructed historical estimates, this is a 7.8% increase in the 12 months to April 2022, the largest upward annual inflation increase since April 1991.

This landmark rise follows an increase in Ofgem’s energy price cap on 1 April 2022, attributed to the quadrupling of global gas wholesale prices. The price cap on energy rose 54% to £1,971 per year.

Price cap increases come twice a year, in April and October. However, Ofgem proposes quarterly increases, saying it will help consumers feel the benefits of falling prices sooner.

The cap increase has forced businesses across the economy to raise their prices and created a fall in ‘real’ disposable incomes for households across the UK, causing a cost of living crisis.

The October 2022 energy price cap increase means the average household will pay £3,549 on annual energy bills. This is triple the amount paid last year. And its projected that electricity and gas prices will continue to increase in 2023.

This comes during a time when the UK is already facing high inflation, cost of living crisis and energy crisis instigated by the economy recovering from COVID-19 lockdown and less imported gas from Russia.

As a result, many homeowners have found renewable energy— through solar panels & heat pumps— to be the solution to becoming energy self-sufficient and independent of the gas and electricity grid.

These energy price surges will impact low-income households and fuel poor households most severely, which spend three times more of their household budgets on energy bills than the richest 20% of households. The UK government is investing 1 billion pounds in the new ECO+ scheme expected to launch in 2023.

Energy price increases, in particular, have renewed calls for a windfall profits tax on oil and gas companies after Shell reported record quarterly gains as a direct result of recent energy market volatility. A 10% tax could raise £2 billion, which supporters say could bring down the price of energy bills and help provide basic needs, such as food.

Those considering the installation of a solar panel and heat pump in the UK can get a competitive cost by comparing quotes. It's important to note that from 1 May 2023 to 31 March 2027, installing certain specified energy-saving materials, including heat pumps and solar panels, is zero-rated for VAT. This means individuals can benefit from significant cost savings when installing these systems, so the heat pump cost and solar panel cost can get less.

The Impact of Energy Inflation

Over-dependence on fossil energy is directly contributing to the current inflation crisis. The biggest contributor to the combined Euro area headline inflation is energy inflation. The rise in inflation in the Euro area is reflected in the rise in energy prices in many countries.

The cost of fossil energy sources will continue to increase as long as we rely on them. However, following similar measures from the UK and US, the EU has announced it will reduce the supply of Russian gas by two-thirds by the end of 2022 in response to the military attack on Ukraine.

Rapidly diverging from current fossil energy sources strains global demand and causes fossil energy prices to hike. Moreover, current market conditions allow energy producers to drive up the cost of importing energy, which is passed on to consumers.

Governments must fast-track a policy landscape that front-loads production of low-carbon heating systems, renovates infrastructure, and establishes an equitable market.

Demand for Natural Gas Ignites a Crisis

Rising gas prices and straining energy demands across the industrial sector put pressure on the cost of living for households as competing primary consumers.

Natural gas makes up over 25% of energy use in the Euro area, making it the second-largest energy resource, following petroleum. In 2019, 90% of the gas consumed by the bloc was imported. Together with petroleum products, making up 64% of total energy imports to the euro area.

Natural gas consumption increased in Europe by 25% by June 2021, the largest year-on-year increase since 1985.

This increase resulted from lower temperatures in April, prolonging the usual heating season for households. Demand was further bolstered by improving global economic activity, emerging close to pre-pandemic levels in the commercial and service sectors.

These heating and industrial requirements also increased electricity demand. Power generation relies on the flexibility of gas-fired power plants to respond quickly to demand surges. The output of gas-fired power plants increased by 25% by June 2021, spiking up to 65% in April due to heating demand pressures.

The inflationary surge of electricity is directly linked to rising oil and gas prices since gas makes up 22% of electricity production. By March 2022, the retail price for gas and electricity rose 65% and 30%, respectively, from the previous year.

Global Demand for LNG Cargoes

Liquefied natural gas (LNG) demand soared due to these heating and production demands in Europe and Asia. This increased global competitiveness and was a primary cause for spot shipping prices to surge to an all-time high of $200,000 early in 2021.

In China especially, limited oil supplies meant demand for natural gas consumption rose 17% from the previous year during this period in 2021. This led to a 28% increase in LNG cargoes in the first half of 2021.

Usual LNG supplies to Europe from the US were strained following extreme freezing in Texas, increasing competitiveness with Asian markets for precious cargoes.

Supplies of LNG were also limited during the summer months. Droughts in South America restricted renewable hydropower capacities, which further diverted LNG supplies to Europe at a time when summer heatwaves dictated the demand for air-conditioning across the global market.

Lagging winds also reduced hydropower capacities in Europe and shifted demand to fossil sources. This was especially the case in the Netherlands and Germany, where wind power makes up to a fifth of their energy use.

These seasonal inefficiencies in renewable power generation strengthened the reliance on oil and gas, constraining supply-demand dynamics and becoming a leading factor in the current crisis.

Plans to REPower the EU

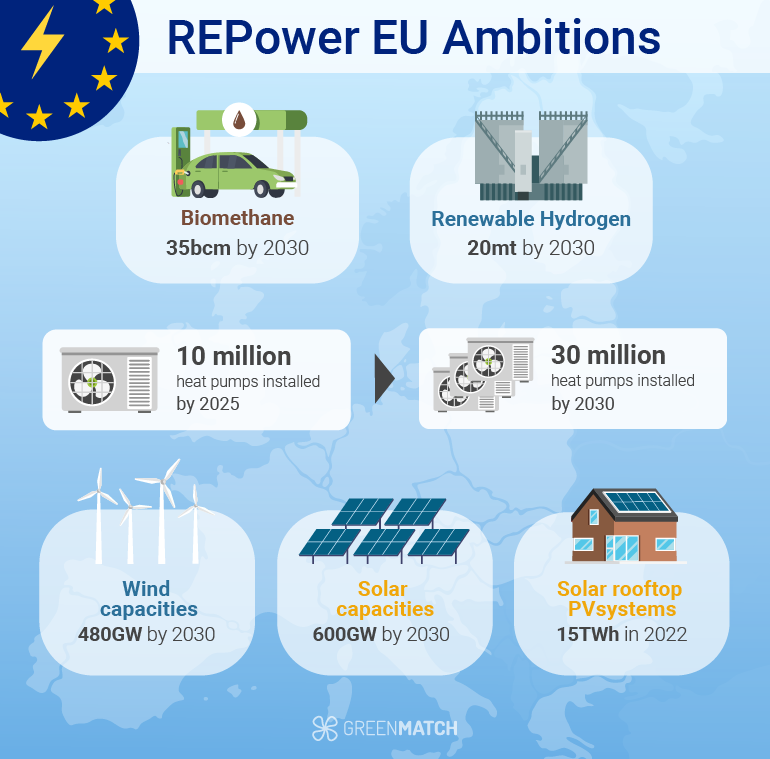

Following the devastating attack on Ukraine, the EU announced its REPower EU ambitions. REPower EU is a series of EU or nationwide measures that aim to transform the energy market to bring a secure supply of energy that is sustainably produced and affordable to consumers, a “trilemma” of interplaying factors, as research from the EUISS puts it.

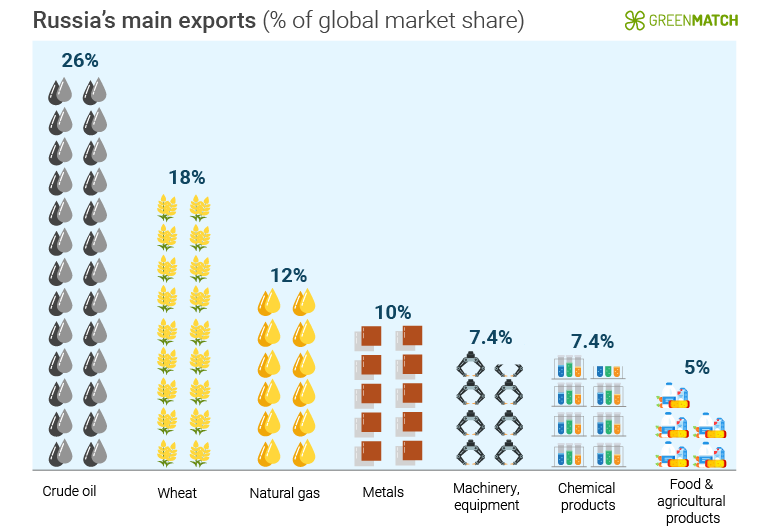

Russia is the world’s largest exporter of natural gas and the second-largest exporter of crude oil. In 2021, the EU imported more than 40% of its natural gas and 27% of its oil from Russia. Since the start of the war, Europe received 71% of Russia’s fossil fuel exports, directly funding the Kremlin's war machine.

Global supply shortages of major Russian-Ukrainian food exports, such as wheat, corn and sunflower, and other exports, such as metals and agricultural products, continue to drive up the price of commodities globally.

The REPower EU proposals address higher energy market prices and low gas storage supplies by establishing a largely self-sufficient EU-wide energy system. This aims to make Europe independent from Russian gas “well before” 2030.

Natural Gas Storage

Inefficient energy infrastructure increases market volatility and inflationary pressures, especially during the shift to renewable energy, which relies on alternative base-load power supplies during supply shortages.

In the EU, gas storage capacities typically supply 25-30% of total natural gas consumption in winter. However, natural gas supplies across Europe fell to new lows across 2021. Moreover, many EU member states rely on a single source of gas, which risks a steady supply during disruptions.

This highlights the importance of reliable infrastructure to meet these gas system demands since this instability ultimately jeopardises the speed of the green transition and threatens energy security.

In light of current supply shocks, the Commission has proposed EU-wide common standards that allow for burden-sharing mechanisms between member states that increase preparedness.

The proposals also set a minimum gas storage obligation of 80% by 1 November 2022 and an annual obligation of 90% by 1 October every year that follows. 13 EU member states currently hold these obligations.

Transforming Europe’s Electricity Market

The key to the REPower EU ambitions is to optimise the electricity market to bring the lowest possible costs for electricity from renewable sources. This will greatly improve energy efficiency, reducing consumption, hardening the market, and shielding households from high prices. Establishing the necessary measures and investments in the medium term will reduce their payback time and reduce energy bills sooner.

These measures could include incentivising efficiency through government-backed 0% loans for renovations and reduced VAT rates for energy-efficiency products. Quick, short-term efficiency measures such as insulating roofs and attics are also advised.

Short-term emergency measures such as temporary regulated price limits for consumers and liquidity support for businesses in energy-intensive industries provide necessary crisis relief. However, these market subsidies strengthen the EU’s reliance on foreign energy suppliers. Therefore, these must remain time-limited.

Improving Efficiency

Co-legislators to REPower EU have advised renovations for the most vulnerable buildings in the EU. This is to establish EU-wide energy performance standards, affecting some 40 million buildings. Current ambitions only require upgrades up to grade E by 2033.

To ensure maximum energy efficiency after widespread heat pump installation, the European Insulation Manufacturing Association (Eurima) clarified that all lower energy performance buildings, F and G class, require deep renovations to reach class C by 2030.

Greenhouse researchers found that renovating Europe’s F/G class buildings to B/C class would reduce gas imports from Russia by 45%.

Financial support, such as subsidies, for these deep renovations must cover most, if not all, of the costs of deep renovations for vulnerable households.

These can be funded through windfall profit taxes, which the International Energy Association estimates could protect against energy prices by bringing €200billion in 2022. Additional funding can be sourced from revenues from the EU’s Emissions Trading System, which generated €30billion in February 2022, from January the previous year.

REPower EU In a Nutshell

The plan's approach will partly come from diversifying gas supplies and pipeline imports from non-Russian sources. This would involve sourcing an additional 50 billion cubic metres (bcm) of LNG supplies annually from across the global market.

Biomethane production from sustainable sources is set to increase to 30bcm per year, and an additional 20 million tonnes of renewable hydrogens through imports and domestic production. Hydrogen sources could replace 25-50bcm of Russian gas by 2030.

The EU Commission will develop a regulatory framework to integrate hydrogen within the existing cross-border gas infrastructure to support the hydrogen market ambitions.

REPower EU also aims to double photovoltaic and wind capacities by 2025 and triple them by 2030, saving 170bcm in yearly gas consumption by the end of the decade. This will require developments across the value chains of these technologies and front-loading emerging technologies through bloc-wide finance schemes.

Ensuring faster permitting processes and upskilling the related workforces will also be critical to deploying these technologies.

The EU plans to implement these ambitions by the summer of 2022 fully. This would lower gas consumption by 30% by the decade's end. These measures will bring the energy equivalent of at least 155bcm of Russian gas.

Combatting the “new age of energy inflation” requires rapid progress towards decarbonisation in the Euro area. Beyond ambition, this demands radical cross-sector policies and the empowerment of consumers. Sweeping efficiency measures, alternative energy supplies and widespread electrification will strengthen the EU’s energy network and minimise the worst effects on the most vulnerable households.

Ciaran is a content writer at GreenMatch. Whether writing about sustainable aviation fuel or heat pumps, Ciaran has passion for informing readers about pivotal technologies that are reshaping our world.

We strive to connect our customers with the right product and supplier. Would you like to be part of GreenMatch?