- GreenMatch

- Blog

- Tidal and Wind Energy in the UK

Enormous Potential of Tidal Energy and Wind Power in the UK

Tidal Energy and Wind Power as Renewable Energy Sources in the UK

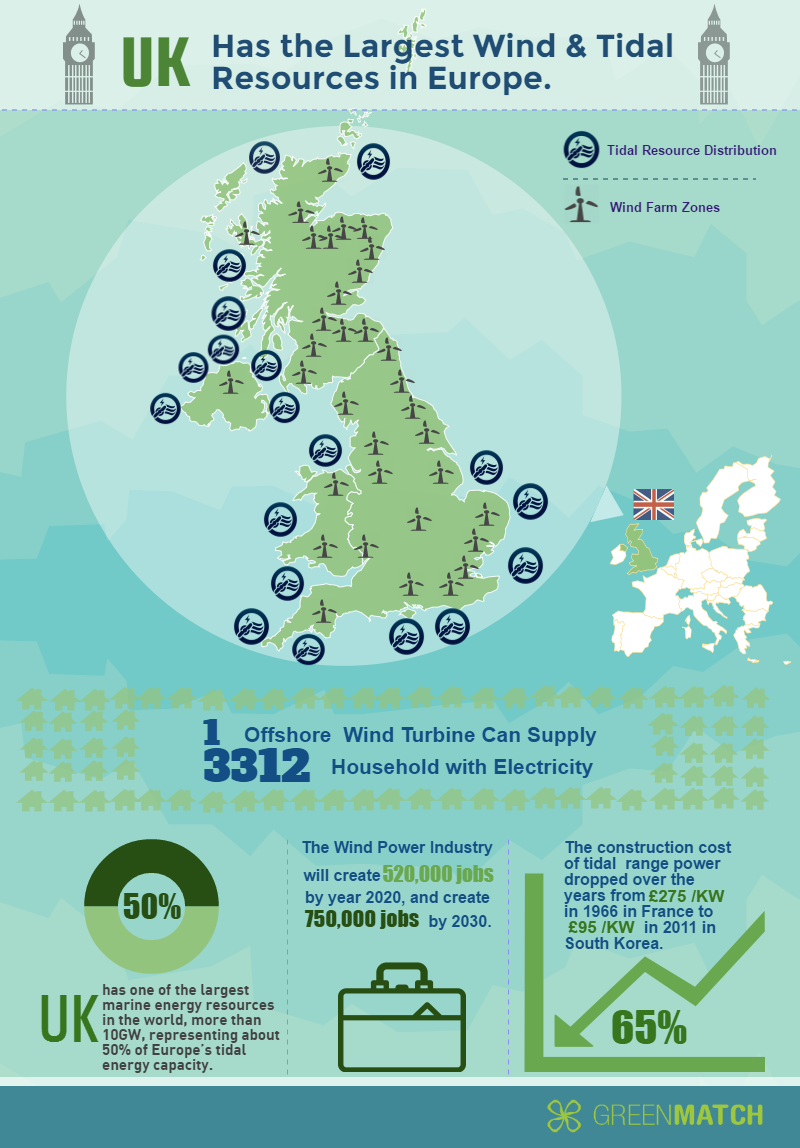

The UK’s tidal power resource is estimated to be more than 10 gigawatts (GW), about 50% of Europe’s tidal energy capacity. Why will the UK miss the target of meeting 20% of energy from renewables by year 2020?

The issues of energy security and rising energy costs to the UK and Europe are of growing concern presently, and renewable solutions from natural resources can contribute to a reliable and efficient solution.

The UK currently generates just under 10% of its power from renewable resources and the government has committed to increasing this percentage over the coming decade. There are other several methods of producing renewable energy, from solar panels, air source heat pumps, and wind turbines.

GreenMatch has created an infographic that represents tidal and wind resources in the UK and their potential.

If you would like to use this infographic on your website, use the embed code below:

What Is Wind Power?

Wind power is the utilisation of of air flow through wind turbines to mechanically power generators for electricity. Wind power is the second largest source of renewable energy after biomass in the UK. It delivers a growing fraction of the energy in the country and it is expected to continue growing for the foreseeable future. Renewable UK estimates that more than 2 gigawatts (GW) of capacity will be deployed per year for the next five years.

The European Wind Energy Association believes Europe could achieve an electricity which is 100% from renewable sources, with wind energy providing 50% of this. Additionally, the European Commission believes that wind energy will supply between 32% and 49% of the EU’s electricity by 2050.

What Is Tidal Energy?

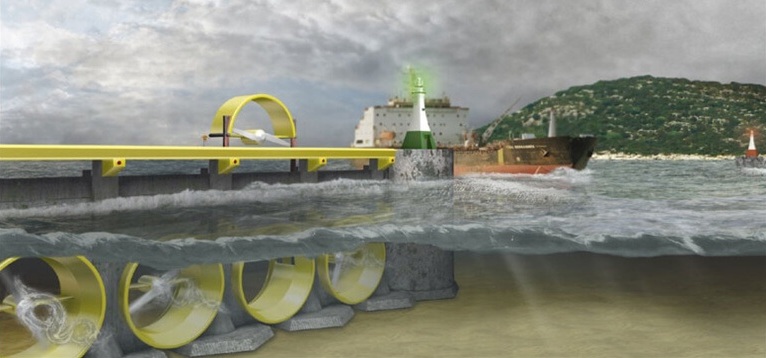

Tidal energy is a type of hydropower produced by the surge of ocean waters during the rise and fall of tides. There are currently three different ways to generate tidal energy: tidal streams, barrages, and tidal lagoons.

Tidal power technologies are not new. Examples were already reported from the Roman times where the ruins of tidal mills installations were found in Europe from around the year 700. In fact, tidal power technologies have advanced considerably over the past few years, and there are a number of ongoing full-scale demonstration projects around the world.

Video on How Tidal Power is Generated

Source: Student Energy, 2015

What Is the Current State of Tidal Power and Wind Energy in the UK?

The UK has established the Renewables Obligation scheme to support the emerging renewables industries. Moreover, the government has indicated that tidal energy projects that are installed by 2017 will be eligible for five Renewable Obligation Certificates (ROCs). This form of incentive will be pivotal in attracting the needed private investment to guarantee that the UK achieves a position as a global leader in the tidal energy sector.

The UK had the highest level of investments in the wind energy sector in 2015, attracting £11.391* billion for the construction of new onshore and offshore wind farms. This accounts for 48% of the total investments made in the wind sector in Europe 2015. Tidal energy and wind power have significant economic benefits. For instance, tidal energy has the potential to power 15 million homes, save 70 million tonnes of carbon and create 16,000 jobs in the UK alone.

According to Eurostat, nine EU countries have surpassed the target of meeting 20% of energy from renewables by year 2020. However, the UK is expected to miss this target. Therefore, Greenmatch asked experts in the renewable energy field in the UK to express their standpoint about the reasons why the UK is far from achieving this target?

According to Professor Ben Wilson from the Scottish Association For Marine Science:

“UK has no energy strategy, and real-time market forces & the constraints on the grid will throttle renewables. Artificially cheap hydrocarbons don't help”.

Dr Alan Owen from Robert Gordon University Aberdeen added:

“The UK does not have the committed long-term buy-in from government. My belief is that renewables are still seen as 'left-wing" by the political class.The flip-flopping over FIT's and other support does not help investors, and Daily Mail campaigns over renewables subsidies (whilst ignoring the subsidies to oil and gas) creates a distorted picture in the public mind, alongside a failure to recognise the importance of energy security”.

And he concluded by stating: “The UK has more resources than it needs but lacks the political will to use them”.

The Levy Control Framework (LCF), which governs the level of subsidy available for clean energy projects in the UK, is expected to provide £7.6 billion worth of financial support for clean energy projects through to 2020. However, the government has in recent months slashed subsidies for a host of renewable energy technologies amidst fears that the LCF cap could be breached before 2020.

Caroline Lucas from Green Party MP urged by stating: "If the Chancellor wants to make a smart investment for a green economy, he should immediately commit to rolling out a nationwide energy efficiency programme - to cut fuel bills, keep people warm in their homes, create thousands of jobs and tackle climate change." (Business Green, 2016).

What Are Wind Turbine Costs?

The cost of investing in wind power as a source of energy varies. The construction of wind farms do not incur any fuel costs for wind power production. As a result, the cost can be predicted with great certainty, unlike the fluctuations in the price of oil, gas, and coal used in other sources of energy production.

Nevertheless, the wind turbine carries the largest cost. This is a capital cost that has to be paid up front. The wind turbines account for 64-84% of total installed costs onshore, with the costs of grid, construction, and other costs making up the balance.

Positively, when the turbine is set and running, there are no fuel and carbon costs apart from operation and maintenance costs (O&M). This is minimal compared to, for instance, a gas power plant where the O&M is 40-70% of total costs.

In 2010, onshore wind was estimated to cost £58.61* per MWh by the European Wind Energy Association electricity cost calculator, but predicted to decrease to £51.85* by 2020. Onshore wind power is competitive once all costs associated with traditional energy sources, such as, fuel and CO2 costs, and the improvements to the environment and people’s health are accounted for.

Offshore wind farms on the other hand are more expensive and cost about £3.16* million per megawatt, with the wind turbine cost accounting for 44% to 50% of the total amount.

If you take into account a cost of £27.09* per tonne of CO2 emitted from traditional power production, than onshore wind energy would be the cheapest source of renewable power generation in Europe.

Examples of Construction Costs for Existing Offshore Wind Farms in the UK

| Project | In Operation | Number of Turbines | Turbine Size | Capacity MW | Investment Costs (Million Euro) |

|---|---|---|---|---|---|

| North Noyle (UK) | 2003 | 30 | 2 | 60 | 121 |

| Scroby Sands (UK) | 2004 | 30 | 2 | 60 | 121 |

| Kentich Flats (UK) | 2004 | 30 | 3 | 90 | 159 |

| Burbo Bank (UK) | 2007 | 24 | 3.6 | 90 | 181 |

| Robin Rigg (UK) | 2008 | 60 | 3 | 180 | 492 |

| Gunfleet Sands 1& 2 | 2010 | 48 | - | 172 | 333 |

| London Array | 2013 | 175 | - | 630 | 2000 |

| Humber Gateway | 2015 | 73 | - | 219 | 818 |

Based on Wyre Energy Ltd., 2013, 4C Offshore.

What Are the Costs of Tidal Energy?

Tidal energy, on the other hand, is expensive to set up compared to wind energy. Investment in tidal power has only been conducted by governments, unlike wind power where there has been an increase in the number of individuals and organisations investing in it over the years. Similar to wind power, tidal power has a long life span and a relatively low cost of operation and no fuel costs.

With only seven main tidal plants operating in the world as of 2011, with one plant in the UK, clear capital costs are unknown. According to the researcher Eleanor Denny, in order for a facility to be profitable, its capital cost should be less than £478,640* per MW.

An example of the cost can be seen with France's La Rance tidal power station, that had an initial cost of about £85.79* million in 1967. In spite of the high initial cost, La Rance power station has been working for close to 45 years to generate sufficient electricity for around 300,000 homes, and the plant's costs have now been recovered. Studies show that the operation and maintenance costs are typically less than 0.5% of initial capital costs.

The main barrier to investments in tidal power plants compared to wind farms is that of high construction costs. Despite that, tidal power has the lowest cost in terms of operations and maintenance (O&M).

Estimated Construction Costs for Existing and Proposed Tidal Barrages

| Country | Project | Capacity (MW) | Power Generation (GWH) | Construction Costs (Million $) | Construction Costs per kW (USD/Kw) |

|---|---|---|---|---|---|

| Operating | |||||

| France | La Rance | 240 | 540 | 817 | 340 |

| South Korea | Sihwa Lake | 254 | 552 | 298 | 117 |

| Planned | |||||

| India | Gulf of Kutch | 50 | 100 | 162 | 324 |

| UK | Wyre Barrage | 61.4 | 131 | 328 | 534 |

| Korea | Garorim Bay | 520 | 950 | 800 | 154 |

| UK | Mersey Barrage | 700 | 1340 | 5741 | 820 |

| Korea | Incheon | 1320 | 2410 | 3772 | 286 |

| Philippines | Dalupiri Blue | 2 200 | 4000 | 3 034 | 138 |

| UK | Severn Barrage | 8 640 | 15 600 | 36 085 | 418 |

| Russia | Penzhina Bay | 87 000 | 200 000 | 328 066 | 377 |

Based on : Wyre Energy Ltd.,2013

Wind Farm Installation and Energy Production

The construction time for wind farms are usually very short. A 10 MW wind farm can be built in two months, while a larger 50 MW wind farm takes six months to build.

Throughout its lifecycle (20-25 years), a wind turbine delivers up to 80 times more energy than is used in its production and maintenance. It takes a turbine three to six months to produce the amount of energy that goes into its manufacture, operation, maintenance, and deterioration after its lifecycle.

At the beginning of January 2015, wind power in the UK comprised of 6,546 wind turbines with a total installed capacity of just under 12 GW, with 7,950 MW of onshore capacity and 4,049 megawatts of offshore capacity.

Wind power generates 2 W/m2 ×4000 m2/person = 8000 W per person, that’s 200 kWh a day per person. Wind turbines start operating at wind speeds of 4 to 5 metres per second and reach maximum power output at around 15 metres per second. At very high wind speeds, that is gale force winds of 25 metres per second, wind turbines shut down.

A modern wind turbine produces electricity 70-85% of the time, but it generates different outputs depending on the wind speed. Over the period of a year, it will typically generate about 24% of the theoretical maximum output (41% offshore). Over their lifecycle they will be running continuously for as much as 120,000 hours. The blades rotate at anything between 15-20 revolutions per minute at constant speed. However, an increasing number of machines operate at variable speed, where the rotor speed increases and decreases according to the wind speed.

Tidal Power Station Installation and Energy Production

The construction of tidal energy projects can take up to 10 years. Once established, electricity can be generated by water flowing both into and out of it. Since there are two high and two low tides each day, electricity generation from tidal power plants is characterised by periods of maximum generation every twelve hours, with no electricity generation at the six hour mark in between. It has been estimated that tidal power stations installed close to the coast can generate up to 1 terawatts globally.

The world's first tidal barrage (La Rance Tidal Power Station) in France with a capacity of 240MW has been running for half a century. It took three years to build and was the world's largest tidal energy generator until 2011, when it was overtaken by South Korea's Sihwa Lake.

Additionally, water is much more dense than air, thus tidal energy is more powerful than wind energy. Unlike wind, tides are predictable and stable; therefore, tidal generators are steady and produce a reliable stream of electricity.

Finally, using indigenous sources of energy, such as wind and tidal power, can help the UK to be more self-sufficient by providing its own power. Owing to these reasons, there is a strong case for supporting the UK government’s drive towards renewable energy. The UK has enormous quantities of predictable, consistent, and reliable marine energy resources. This way of generating electricity can be an important component in the future global energy mix.

Note: The original currencies have been converted in this article so some approximation errors might occur; the conversions are from Euros to British pound using the conversion rates below:

* = (Converted currency)

Euro → British Pound

1 EUR = 0.903588 GBP 1 GBP = 1.10670 EUR

We strive to connect our customers with the right product and supplier. Would you like to be part of GreenMatch?