Answer these simple questions and we will find you the BEST prices

Which type of solar quotes do you need?

It only takes 30 seconds

100% free with no obligation

Get up to 3 quotes by filling in only 1 quick form

Slash your energy bills by installing an energy efficient boiler

We’ve helped over 500,000 homeowners reduce their carbon footprint

- GreenMatch

- Blog

- Boiler Cover: What Do You Need To Be Aware Of

Boiler Cover: A Guide To Choosing The Right Insurance Plan

What to Be Aware of When Choosing a Boiler Service

A boiler cover is a relatively small price to pay in order to make sure that you do not run into huge maintenance costs, and that you won’t be handed a hefty bill for some unexpected repairs. It is worth mentioning that the property owners are usually the ones who would like to consider a boiler cover, whereas the tenants who normally rent the place are not responsible for insurance-related expenses.

In general, the insurance providers offer a 24/7 protection plan that would cover the boiler and the controls in case of a failure and will make it easier to get in touch with a helpline specialist that can send an engineer to your address.

There are few things to keep in mind when considering a coverage plan for your boiler:

- The age factor - in order to be eligible for the insuring scheme, most of the insuring companies would expect your boiler to be no more than seven years old, otherwise, a boiler inspection might be required before an agreement can be signed.

- If there is an upper limit on the number of call-outs you are permitted to make during a certain period of time. In addition to this, you might want to consider the highest payout amount the insurance provider is willing to pay for a single call-out request.

- If you are required to pay an excess fee. A cheap insurance plan might prove to be a bargain, but most probably it will carry an excess fee, which is usually around £50, depending on the insurance provider. Therefore, you might be looking for a more expensive boiler cover that would not include any hidden costs.

- The boiler’s type - as a general rule, the insuring companies provide coverage for all types of boilers available on the market, starting with conventional gas boilers, biomass boilers, wood pellet boilers, condensing boilers, and ending with a more sophisticated option of a combi boiler. Thus, you can customize your insurance plan in accordance with the boiler type you own or wish to purchase.

- If there are any additional costs you have to be aware of.

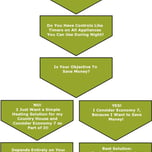

Boiler Cover Types

Choosing the most appropriate coverage very much depends on the current condition of your boiler. If it is a new or a well preserved boiler system, then a less expensive and ‘boiler-only’ cover will be preferable. Such an insurance scheme will cover the boiler itself and would not provide additional coverage for the central heating system. If the boiler you are looking to insure has a few years behind, and if you are wary about the damages a boiler failure might inflict on the central heating system, then a more expensive insurance plan that will cover both the boiler and the central heating system is desirable.

If the above mentioned options does not suit you, then a home emergency coverage might be the optimal solution in your case. The immediate benefits of a home emergency insurance plan stems from the broad coverage it can offer, providing protection from boiler and central heating failures to drainage and electricity breakdown, allowing for an unlimited number of call-outs. The drawback of such an insurance plan is that the cover up amount is usually capped at £500, and it is only provided in case of an emergency, which might not be the case when faced with a minor boiler issue, that usually can be covered by a ‘boiler only’ insurance plan.

Fill in the form in just 1 minute

We strive to connect our customers with the right product and supplier. Would you like to be part of GreenMatch?